Presented by Mark Gallagher

General market news

• The 10-year Treasury traded in a tight range last week, with a low of 1.72 percent and a high of 1.84 percent, opening with a yield of 1.77 percent this Monday morning. The 30-year began the week with a yield of 2.63 percent after trading in the range of 2.59 percent to 2.70 percent last week.

• Equity prices shot higher in early trading last week, with domestic and international indices averaging gains of more than 3 percent. International indices managed to outperform domestic indices for the most part thanks to a weakening dollar. Growth-oriented stocks continued to outpace value stocks.

• Oil prices kept up their march higher last week, with Brent crude touching $35 per barrel for the first time since early January. Rig counts have been cut dramatically over the last year, but supply and inventories still remain high.

| Equity Index | Week-to-Date | Month-to-Date | Year-to-Date | 12-Month |

| S&P 500 | 2.90% | −0.95% | −5.86% | −6.60% |

| Nasdaq Composite | 3.91% | −2.21% | −9.86% | −7.45% |

| DJIA | 2.75% | −0.09% | −5.47% | −6.48% |

| MSCI EAFE | 5.25% | −1.23% | −8.36% | −13.10% |

| MSCI Emerging Markets | 4.97% | 0.59% | −5.94% | −22.16% |

| Russell 2000 | 3.93% | −2.36% | −10.95% | −16.58% |

Source: Bloomberg

| Fixed Income Index | Month-to-Date | Year-to-Date | 12-Month |

| U.S. Broad Market | 0.55% | 1.93% | 2.00% |

| U.S. Treasury | 0.93% | 3.08% | 3.61% |

| U.S. Mortgages | 0.32% | 1.63% | 2.90% |

| Municipal Bond | 0.39% | 1.58% | 4.33% |

Source: Morningstar Direct

What to look forward to

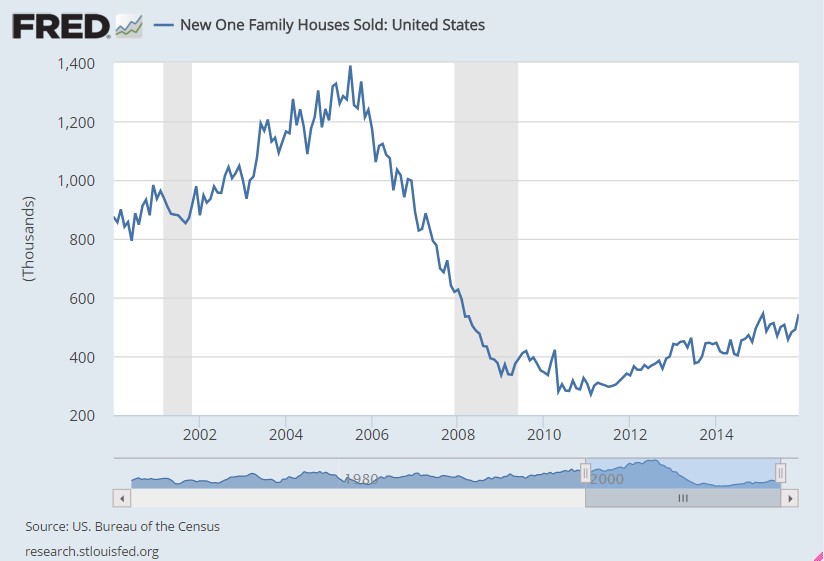

We will see more housing data this week, with releases of both Existing and New Home Sales.

Durable Goods Orders are expected to have ticked up in January, while the preliminary estimate of Fourth-Quarter Gross Domestic Product is expected to drop to 0.5 percent.

The week will end with data on Personal Income and Outlays, with both income and spending expected to improve, as well as Consumer Confidence.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Barclays Capital Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Barclays Capital Mortgage-Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Barclays Capital Municipal Bond Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million. The Barclays Capital U.S. Treasury Inflation Protected Securities (TIPS) Index measures the performance of intermediate (1- to 10-year) U.S. TIPS.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2016 Commonwealth Financial Network®