Presented by Mark Gallagher

General market news

• Treasuries sold off last week. The 10-year yield moved from 2.22 percent at the start of the week to 2.33 percent by Tuesday afternoon. It moved lower later in the week and opened this Monday at 2.27 percent. The 30-year yield was as low as 2.79 percent last Monday before jumping to 2.94 percent midweek; it opened this Monday at 2.87 percent.

• The U.S. equity markets were mixed last week. The S&P 500 Index was flat, the Nasdaq Composite Index ticked down 0.19 percent, and the Dow Jones Industrial Average gained 1.17 percent. The Dow benefited from a nearly 10-percent gain in Boeing following its second-quarter earnings call, during which the company announced that it beat expectations and was raising its forecast due to increased demand for aircraft in India. With about half of S&P 500 companies reporting earnings at this point, the estimated earnings growth rate has increased to 10.7 percent for the second quarter. This week, earnings announcements from Apple (AAPL), Tesla (TSLA), and Pfizer (PFE) have the potential to move markets.

• Outside of company earnings, other major news last week included the Federal Open Market Committee (FOMC) announcement that it would begin trimming the balance sheet “relatively soon” and the first estimate of second-quarter gross domestic product (GDP), which came in at 2.6 percent. Both of these announcements were largely expected, which may explain why the markets didn’t react significantly.

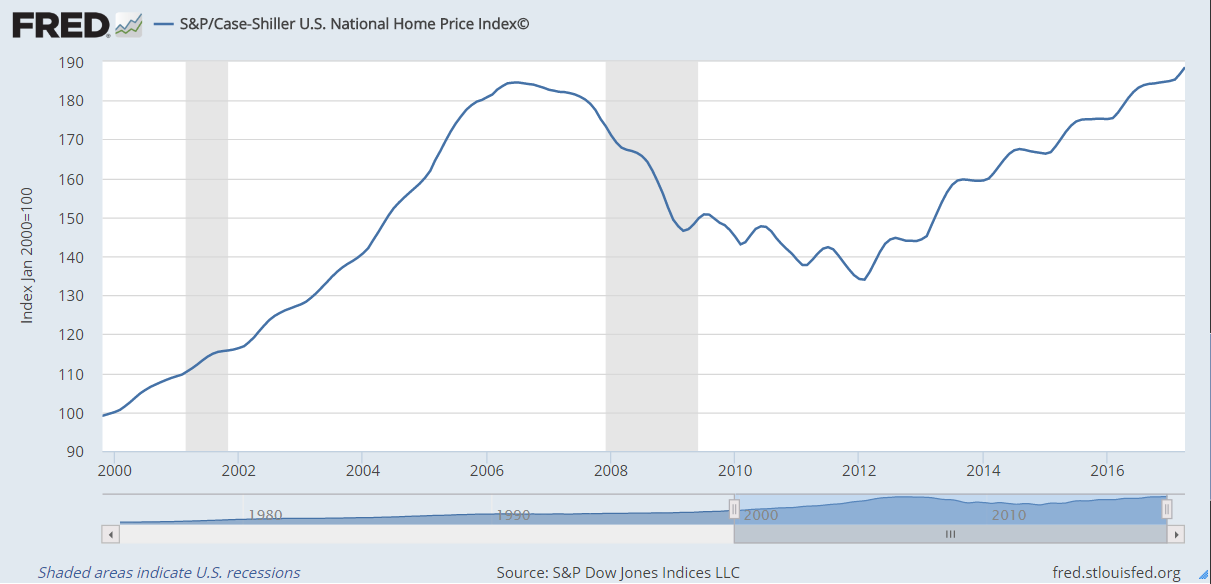

• A number of other important economic indicators were released last week. On Monday, we learned that existing home sales decreased by 1.8 percent. Although this was below expectations, much of the slowdown can be attributed to lack of supply, not demand, as home prices continued to increase. New home sales, released on Wednesday, increased 0.8 percent, which was in line with expectations. On Thursday, durable goods orders, a sign of business demand, came in much better than expected, growing 6.5 percent—against expectations for 3.9-percent growth. Much of this strength was due to increases in non-military airline sales. After a slight decline in May, this return to growth is encouraging.

| Equity Index | Week-to-Date | Month-to-Date | Year-to-Date | 12-Month |

| S&P 500 | 0.00% | 2.13% | 11.67% | 16.31% |

| Nasdaq Composite | –0.19% | 3.86% | 19.19% | 25.21% |

| DJIA | 1.17% | 2.39% | 11.96% | 21.32% |

| MSCI EAFE | 0.23% | 2.62% | 17.22% | 20.31% |

| MSCI Emerging Markets | 0.30% | 5.70% | 25.35% | 24.61% |

| Russell 2000 | –0.45% | 1.03% | 6.07% | 19.02% |

Source: Bloomberg

| Fixed Income Index | Month-to-Date | Year-to-Date | 12-Month |

| U.S. Broad Market | 0.43% | 2.72% | –0.51% |

| U.S. Treasury | 0.18% | 2.05% | –2.54% |

| U.S. Mortgages | 0.43% | 1.79% | 0.17% |

| Municipal Bond | 0.77% | 4.36% | 0.21% |

Source: Morningstar Direct

What to look forward to

We will see a wide range of economic news this week, including consumer income and spending; the state of business confidence in both the manufacturing and service sectors; the international trade report; and, most important, the July jobs report.

Personal income, released on Tuesday, is expected to show strong growth of 0.4 percent in June, the same as in May. Continued job and wage growth have been pushing incomes up. Personal spending, on the other hand, is expected to show growth of just 0.1 percent in June, the same as in May. Despite positive income growth, ongoing weakness in spending growth suggests that the economy may remain steady in the second half of the year, rather than accelerate.

Also on Tuesday, the Institute of Supply Management (ISM) will release its manufacturing survey, which is expected to drop from 57.8 in June to 56.2 in July. This is a diffusion survey, where values over 50 indicate expansion. June’s figure was the highest in nearly three years, so even with a decline, manufacturing will remain at a healthy level. Faster global growth and a weaker dollar have supported U.S. manufacturing, so there may be some upside here.

On Thursday, the ISM will release the nonmanufacturing, or service sector, survey. This survey is also expected to show a small decline—from 57.4 to 56.8—although this too would still be a healthy level. Although we have seen weakness in retail sales, and some surveys have pulled back a bit, activity picked up in the second quarter overall, and the expected result would be positive for the economy.

On Friday, the International Trade report is expected to show a small narrowing of the trade deficit, from $46.5 billion to $45.5 billion. Strengthening exports have benefited the goods trade deficit, while the service trade balance has remained roughly constant. A lower deficit is better for U.S. economic growth, so any improvement would be constructive.

The highlight of the week will be Friday’s employment report. It is expected to show job growth of 183,000 in July, down from 222,000 in June. There is upside risk here, as jobless claims remain quite low, and temporary help growth has been strong. The unemployment rate is expected to drop from 4.4 percent to 4.3 percent. Meanwhile, wage growth may pick up from 0.2 percent to 0.3 percent while the average workweek remains constant. This will be a strong report, and very positive for the economy, if it comes in as expected.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg Barclays US Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg Barclays US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg Barclays US Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2017 Commonwealth Financial Network®