Presented by Mark Gallagher

General market news

• Since reaching a high of 2.41 percent on November 19, the yield on the 10-year Treasury has hovered around 2.34 percent. The 30-year has moved back below 2.80 percent—a level it has reached only a few times in the past year. Meanwhile, the 2-year is back above 1.75 percent. As the short end of the curve moves higher and the long end maintains its levels or moves lower, the flattening yield curve is increasingly something we need to pay attention to.

• Markets were up across the board during the holiday-shortened week. Technology stocks helped support the advance of the Nasdaq Composite and the S&P 500 Index, as Apple and Amazon posted gains of 2.83 percent and 4.97 percent, respectively. In fact, the S&P notched a new record high on November 21.

• Other top-performing sectors included telecom, industrials, and consumer discretionary. High expectations for the retail space should help consumer discretionary stocks. Earlier this month, Alibaba’s (BABA) Singles’ Day generated $25.3 billion in sales. Black Friday and Cyber Monday are expected to follow this strong performance. Those sectors that lagged on the week were consumer staples, utilities, and financials.

• Last week saw existing home sales come in very close to the consensus estimate. The number of homes sold increased 2 percent over the previous month, but sales were down 0.9 percent from last year. Because demand remains strong, supply continues to dwindle; it fell 3.2 percent, to 1.8 million homes.

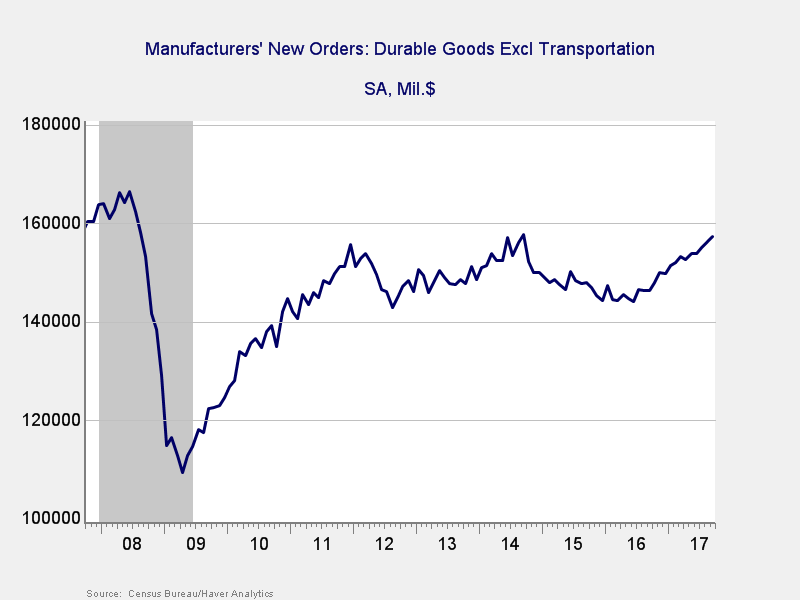

• Durable goods orders were released on Wednesday, coming in well below the consensus with a decline of 1.2 percent month-over-month. Expectations were for a 0.4-percent increase. Commercial aircraft orders declined significantly but are expected to bounce back in November. Removing transportation, durable goods orders increased 0.4 percent, and the previous report was revised upwards by 0.4 percent as well.

• The University of Michigan consumer sentiment survey came in slightly above the consensus at 98.5—a sign that consumers’ confidence in the economy remains strong.

| Equity Index | Week-to-Date | Month-to-Date | Year-to-Date | 12-Month |

| S&P 500 | 0.93% | 3.61% | 18.36% | 20.44% |

| Nasdaq Composite | 1.58% | 6.25% | 29.34% | 29.55% |

| DJIA | 0.89% | 5.52% | 21.83% | 26.44% |

| MSCI EAFE | 1.88% | 2.76% | 23.84% | 29.25% |

| MSCI Emerging Markets | 1.57% | 6.80% | 36.82% | 38.37% |

| Russell 2000 | 1.77% | 2.04% | 13.19% | 29.25% |

Source: Bloomberg

| Fixed Income Index | Month-to-Date | Year-to-Date | 12-Month |

| U.S. Broad Market | 0.19% | 3.39% | 3.64% |

| U.S. Treasury | 0.11% | 2.38% | 2.32% |

| U.S. Mortgages | 0.12% | 2.40% | 2.59% |

| Municipal Bond | –0.36% | 4.77% | 5.20% |

Source: Morningstar Direct

What to look forward to

This week, we’ll get a detailed look at the consumer, as well as sentiment at manufacturing companies.

On Tuesday, the Conference Board will release its confidence survey. The reading is expected to pull back a bit from a 16-year high of 125.9 in October to a still very high 124.0 in November. Strong job and stock markets should keep the index high, but rising gas prices may temper results. Even with the expected pullback, confidence is unusually high, and consumers are feeling very good. This is consistent with faster growth.

On Thursday, the personal income and spending reports will show whether consumers’ behavior is in line with confidence levels. Personal income growth is expected to pull back slightly, from a strong 0.4 percent in September to a still healthy 0.3 percent in October. Faster job growth in the aftermath of the hurricanes was offset by slower wage growth, so there may be some downside risk here. Personal spending growth also is expected to pull back from a 1-percent gain in September—when vehicle sales and rising gas prices buoyed growth—to a healthy gain of 0.3 percent in October. If the data comes in as expected, this will be a positive result for consumers, who represent the largest part of the economy.

Finally, on Friday, the Institute for Supply Management’s survey of manufacturing businesses is likewise expected to pull back from October’s seven-year high of 58.7 to 58.4. This is a diffusion index, where numbers above 50 indicate expansion. So, even with a small pullback, this index would still suggest strong growth. With declines in similar surveys, there may be more downside risk here, but the indicator would still be quite positive even with a larger pullback.

Although there may be some weakening of the data this week, it will be from very high levels and so nothing to worry about. Overall, this week’s data should keep pointing toward economic growth.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg Barclays US Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg Barclays US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg Barclays US Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2017 Commonwealth Financial Network®