Presented by Mark Gallagher

General market news

• On Monday morning, the 10-, 30-, and 2-year Treasuries opened at 2.81 percent, 2.96 percent, and 2.62 percent, respectively. The spread between the 2- and 10-year notes is again at its flattest level in this economic cycle. Historically, an inverted yield curve—where rates on the short end are higher than on the long end—has been a very strong indicator of an economic recession. We seem to be getting much closer to an inversion as we head into fall. Usually, once the curve inverts, a recession occurs within the following 12 to 18 months.

• U.S. markets moved higher last week, ignoring domestic political concerns and a midweek trade discussion between the U.S. and China. The energy and technology sectors helped fuel the uptick. A move in oil was supported by a 4.3-percent increase in West Texas Intermediate crude, which bounced back after dropping for six of the previous seven weeks. Sector laggards for the week included consumer staples, utilities, and REITs.

• Last week also saw the release of a handful of important economic data points. On Wednesday, existing home sales disappointed, declining 0.7 percent against expectations for a modest 0.4-percent increase. On Thursday, new home sales also came in below expectations, falling 1.7 percent, against expectations for a 2.2-percent uptick. Given climbing home prices, low supply, and rising interest rates, a slowdown in housing growth may be in the cards.

• On Friday, durable goods orders for July came in below expectations, down 1.7 percent. The drop follows several months of robust growth, so this result is not a cause for concern.

• Finally, also on Friday, Federal Reserve (Fed) Chair Jerome Powell made his first speech at the annual Jackson Hole Economic Policy Symposium. Many interpreted his remarks to be slightly dovish, suggesting that the Fed would continue its gradual path of rate hikes.

| Equity Index | Week-to-Date | Month-to-Date | Year-to-Date | 12-Month |

| S&P 500 | 0.88% | 2.26% | 8.87% | 20.15% |

| Nasdaq Composite | 1.67% | 3.71% | 15.92% | 28.07% |

| DJIA | 0.51% | 1.75% | 5.90% | 21.09% |

| MSCI EAFE | 1.57% | –2.18% | –2.15% | 5.29% |

| MSCI Emerging Markets | 2.71% | –3.27% | –7.55% | –0.36% |

| Russell 2000 | 1.94% | 3.37% | 13.24% | 27.20% |

Source: Bloomberg

| Fixed Income Index | Month-to-Date | Year-to-Date | 12-Month |

| U.S. Broad Market | 0.76% | –0.84% | –0.69% |

| U.S. Treasury | 0.86% | –0.64% | –1.20% |

| U.S. Mortgages | 0.67% | –0.39% | –0.27% |

| Municipal Bond | 0.29% | 0.29% | 0.66% |

Source: Morningstar Direct

What to look forward to

On Tuesday, the Conference Board Consumer Confidence Index is expected to decline slightly due primarily to rising inflation concerns. Wage growth has been relatively muted over the past year, so the increase in consumer inflation we’ve experienced in the past few months is starting to be felt. Nevertheless, consumer confidence should remain near recent highs, as the overall strength of the economy continues to inspire confidence.

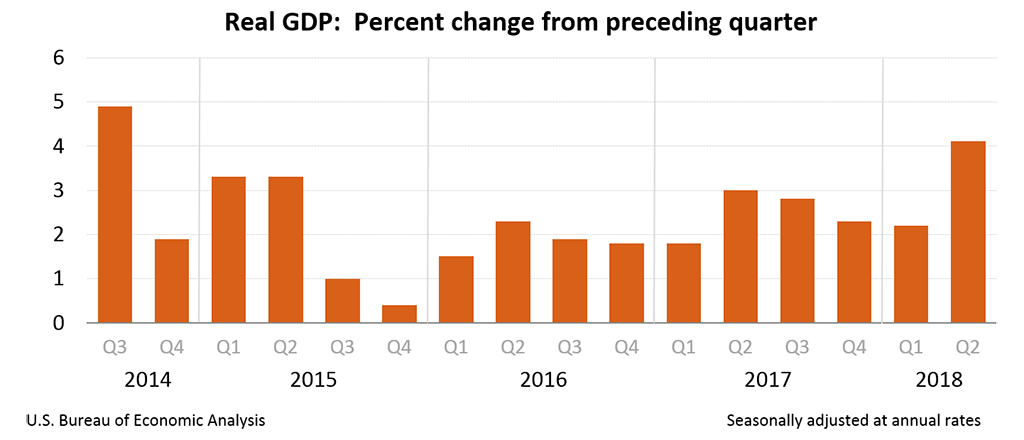

On Thursday, July’s personal income and spending data is set for release. Both are expected to grow 0.4 percent, which is in line with June’s growth levels. Strong growth in these measures to start the third quarter would be a good sign for overall economic growth for the second half of the year.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg Barclays US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg Barclays U.S. Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2018 Commonwealth Financial Network®