Presented by Mark Gallagher

General market news

• Rates were flat or slightly down during the shortened Thanksgiving week. On Monday morning, the 10-year Treasury opened at 3.05 percent, the 2-year opened at 2.84 percent, and the 30-year opened at 3.32 percent. During the previous week, rates dropped by as much as 20 basis points.

• All three major U.S. markets were down last week, as oil and technology stocks continued to decline. West Texas Intermediate crude oil dropped more than 9 percent to $51.28 due to ongoing supply concerns and decreasing demand. Oil also faced pressure on news that Saudi Arabia may not force an oil production cut.

• Apple (AAPL) and Facebook (FB) both faced their own issues last week. Apple shares came under pressure after the Wall Street Journal reported that the company had cut its production of all three versions of its new phones launched in September. Facebook CEO and founder Mark Zuckerberg is reportedly unhappy with the way Sheryl Sandberg, chief operating officer, handled the Cambridge Analytical scandal, leading to concerns over a change of key personnel at the company.

• Last week was relatively busy, even with the Thanksgiving holiday. On Tuesday, October’s housing starts and building permits reports came in. These were a mixed bag, as housing starts rose slightly while permits declined slightly.

• On Wednesday, October’s durable goods orders fell by 4.4 percent, against expectations for a more modest 2.6-percent loss. This miss was largely due to a decline in volatile aircraft purchases. The core figure, which strips out transportation, rose by 0.1 percent.

• Finally, also on Wednesday, the University of Michigan consumer sentiment survey declined slightly from 98.3 to 97.5. This still represents a very healthy level of consumer optimism heading into the important holiday shopping season.

| Equity Index | Week-to-Date | Month-to-Date | Year-to-Date | 12-Month |

| S&P 500 | –3.77% | –2.74% | 0.18% | 3.11% |

| Nasdaq Composite | –4.25% | –4.89% | 1.51% | 1.82% |

| DJIA | –4.40% | –3.05% | 0.26% | 5.42% |

| MSCI EAFE | –1.08% | –1.05% | –9.79% | –8.44% |

| MSCI Emerging Markets | –1.72% | 1.43% | –14.30% | –13.69% |

| Russell 2000 | –2.53% | –1.41% | –2.00% | –0.76% |

Source: Bloomberg

| Fixed Income Index | Month-to-Date | Year-to-Date | 12-Month |

| U.S. Broad Market | 0.46% | –1.92% | –1.86% |

| U.S. Treasury | 0.74% | –1.41% | –1.57% |

| U.S. Mortgages | 0.51% | –1.19% | –1.18% |

| Municipal Bond | 0.56% | –0.45% | 0.14% |

Source: Morningstar Direct

What to look forward to

This week is a busy one on the economic front, giving us a wide range of information on where the economy is going.

On Tuesday, the Conference Board Consumer Confidence Index is expected to pull back slightly, from an almost two-decade high of 137.9 to a still very high 136.2. This pullback would be due to rising gas prices and recent stock market turbulence. Even with the pullback, confidence would remain close to its highest level in the past 20 years and would be supportive of continued growth.

On Wednesday, the second estimate of third-quarter gross domestic product growth is expected to be slightly better than the previous estimate, coming in at 3.6 percent. This number would indicate continued healthy growth, but it would also suggest that growth at the level of the first quarter may not be sustainable.

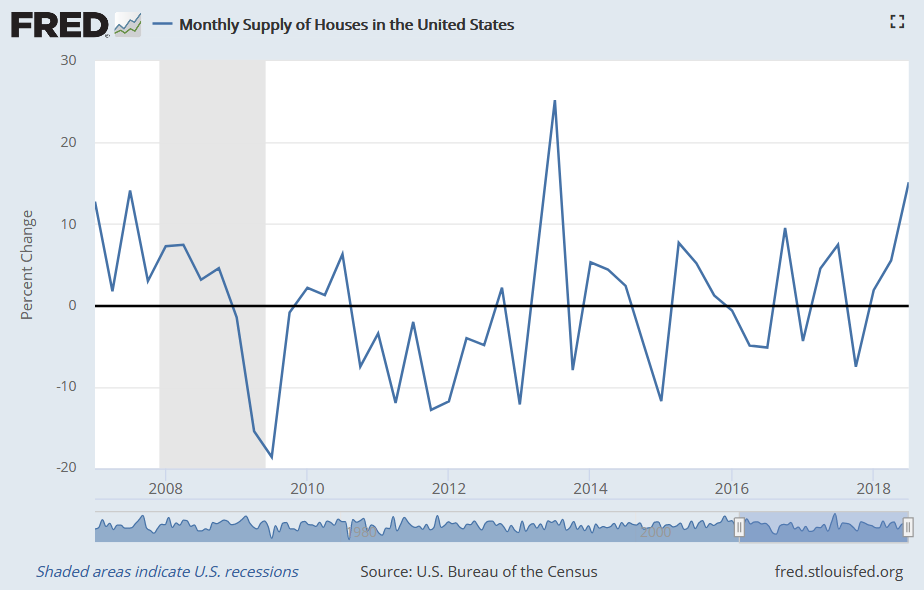

Also on Wednesday, the new home sales report is expected to improve, from 553,000 to 583,000, after a disappointing result last month. If the number comes in as expected, it will signal that while housing growth continues to slow, the downtrend may not be quite as bad as last month’s data suggested.

On Thursday, the personal income and spending report will be released. It is likely to show that personal income rose by 0.4 percent in October, up from 0.2 percent in September, due to faster job and wage growth. There may be some upside risk here, as hours worked also likely rose last month. Personal spending is expected to stay steady at 0.4 percent in October, the same as in September, due to a rebound in services spending. This result would indicate that spending growth remains at a healthy level and would be well supported by income growth.

Finally, on Friday, the minutes from the November Federal Reserve (Fed) meeting will be released. Markets are looking for confirmation that a rate hike is on the way in December and for the Fed’s reaction to weaker business investment. They will also be looking, probably in vain, for any hints that the Fed may slow or delay the rate increase process.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg Barclays US Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg Barclays US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg Barclays US Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2018 Commonwealth Financial Network®