Presented by Mark Gallagher

General market news

• The 10-year Treasury was as low as 2.41 percent late last week before opening at 2.45 percent on Monday. Yields across the curve were lower, with the 2-year Treasury opening at 2.31 percent and the 30-year Treasury opening at 2.89 percent. As a result of slowing global growth, the dovish stance from the Federal Reserve (Fed), and tariff and debt concerns, investors have piled into more safety assets over the last couple of weeks. For the first time in this cycle, the 3-month yield was higher than the 10-year yield. That yield differential was small (–2.974 basis points) and reversed on Monday morning; however, it has become increasingly likely that we will see a full curve inversion at some point.

• The three major U.S. markets were down last week, as global growth fears led to a strong Friday sell-off. This result can be attributed to both the yield curve inversion and a weak Purchasing Managers’ Index (PMI) report out of Germany. The German PMI report, which has dropped significantly since its peak in 2017, marked the lowest level since 2012 for German manufacturers. The report stokes fears that China is not the only global marketplace that is seeing a slowdown in growth.

• The top-performing sectors on the week were consumer discretionary, REITs, and consumer staples. The worst-performing sectors were materials, industrials, and financials, which struggled in light of the yield curve inversion.

• There was no change in the National Association of Home Builders Housing Market Index during the month. It remained at 62.

• The Federal Open Market Committee (FOMC) rate decision came on Wednesday, with the Fed deciding not to change rates. The Fed dot plot indicated no rate hikes for the remainder of 2019. In addition, the Fed released a plan to begin to slow the pace of the balance sheet wind down in May and to finish winding down by the end of September. All of these moves were interpreted as more dovish than the market expected.

• On Friday, existing home sales showed strong gains of 11.8 percent. This result was well above the expectation for a 3.8-percent gain and reversed the previous month’s decline of 1.4 percent.

| Equity Index | Week-to-Date | Month-to-Date | Year-to-Date | 12-Month |

| S&P 500 | –0.75% | 0.70% | 12.26% | 8.07% |

| Nasdaq Composite | –0.58% | 1.53% | 15.48% | 7.81% |

| DJIA | –3.05% | –1.47% | 9.97% | 8.93% |

| MSCI EAFE | –0.33% | 0.79% | 10.17% | –3.40% |

| MSCI Emerging Markets | 0.24% | 0.92% | 10.02% | –8.93% |

| Russell 2000 | –3.05% | –4.31% | 11.99% | –1.13% |

Source: Bloomberg

| Fixed Income Index | Month-to-Date | Year-to-Date | 12-Month |

| U.S. Broad Market | 1.38% | 2.61% | 4.68% |

| U.S. Treasury | 1.24% | 1.74% | 4.40% |

| U.S. Mortgages | 1.09% | 2.00% | 4.66% |

| Municipal Bond | 1.25% | 2.48% | 5.21% |

Source: Morningstar Direct

What to look forward to

This week will be a busy one for economic news, including looks at housing, trade, confidence, and consumer income and spending.

The data flow starts on Tuesday, with the release of the housing starts report. Starts are expected to drop back slightly, from 1.23 million annualized in January to 1.21 million in February. This would still be a very good result, as the January number was a nine-month high. There is likely to be some downside risk, however, as single-family building permits dropped back last month, and multifamily starts are likely to remain steady. If the numbers come in even close to expectations, it would be a positive signal for the industry and economy.

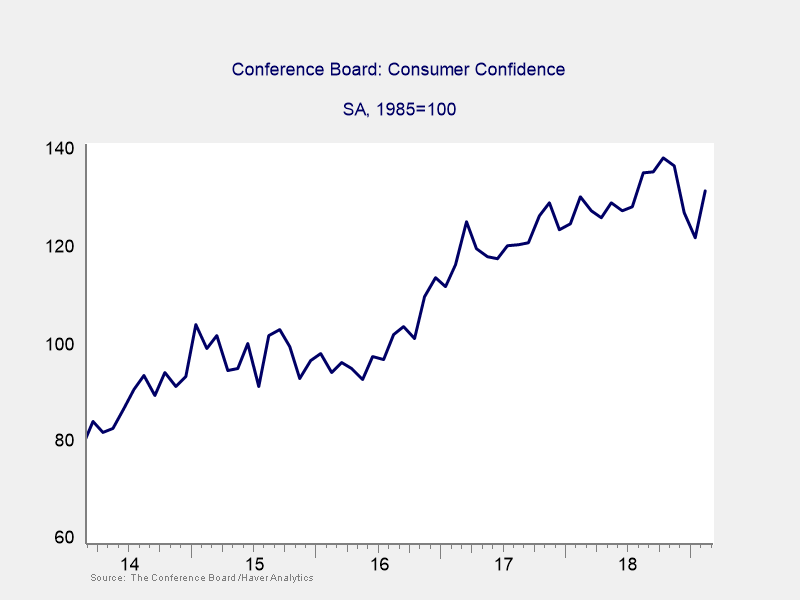

Also on Tuesday, the Conference Board will release its consumer confidence survey. It is expected to tick up a bit, from 131.4 in February to 132 in March. This result would continue the index’s rebound after a recent decline, leaving it at a relatively high level historically. With gas prices and the stock market rising during the month, there may be some upside risk here.

On Wednesday, the international trade report will be released. It is expected to show an easing in the trade deficit, from $59.8 billion in December—which was a 10-year high—to $57.3 billion in January. The improvement should come from a rise in Chinese soybean purchases and a drop in imports, rather than a rise in exports. Overall, trade is likely to be a drag on growth in the first quarter if the numbers come in close to expectations.

Finally, on Friday, the personal income and spending report is expected to show renewed growth in income, up from a drop of 0.1 percent in January to a gain of 0.3 percent for February. Last month’s drop was technical rather than fundamental—a timing issue related to dividend payments—so continued growth would be a positive sign. Personal spending is expected to rebound even more, from a 0.5-percent drop in December to a 0.3-percent gain in January. The difference in timing between the reports here is due to the ongoing catchup from the government shutdown. Again, the rebound would be consistent with renewed confidence and would be a positive sign.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg Barclays US Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg Barclays US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg Barclays US Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2019 Commonwealth Financial Network ®