Presented by Mark Gallagher

General Market News

• The 10-year Treasury yield opened at 0.65 percent on Monday morning before bouncing up to 0.70 percent. The 10-year traded between 0.59 percent and 0.75 percent last week. The 30-year opened at 1.42 percent, and the 2-year opened at 0.18 percent—both higher than where they ended last week. There are some whispers of the Federal Reserve stepping up its bond buying activity to help keep rates lower.

• Global equities rallied last week, as several planned reopenings supported value stocks that have been punished since the beginning of the pandemic. In fact, value stocks outperformed growth for the week. Some of the better-performing value areas included energy, REITs, consumer discretion. Financials outperformed the market last week, as regional banks rallied in this beaten-down stock bounce. The rally was also supported by positive vaccine trial news from Moderna, which saw all 8 healthy candidates in a 45-person trial develop protective antibodies. Central bank policy was cited as a reason for the rally in risk assets, as liquidity has been supported by central banks stepping into markets as needed. The top-performing sectors this week were industrials, energy, and REITs. The sectors that lagged were health care, consumer staples, utilities, and the technology sector, which has led the recovery off of March lows.

• We started the week with Monday’s release of the National Association of Home Builders Housing Market Index for May. This measure of home builder confidence increased from 30 in April up to 37 in May, slightly better than expectations for an increase to 35. This follows a steep fall from 72 in March down to an 8-year low of 30 in April, so the modest rebound we saw in May still leaves the index well below levels seen earlier this year. Home builders cited construction challenges due to social distancing and significant declines in prospective buyers as two key factors causing sentiment to plunge in April, and these headwinds likely persisted into the start of May. Low levels of home builder confidence are expected to slow the pace of new home construction.

• Speaking of which, on Tuesday, April’s building permits and housing starts reports were released. These measures of new home construction showed a sharp decline in April, with housing starts falling by 30.2 percent against expectations for a 26 percent decline. Building permits fell by 20.8 percent during the month, less than the 25.9 percent fall that was anticipated. This was the largest percentage decline for housing starts since records began in 1959, and this worse-than-expected result brought the pace of new home construction to its lowest level since February 2015. These reports can be volatile on a month-to-month basis; however, given the headwinds to the industry and the continued pessimism from home builders, further weakness in new home construction is expected.

• We finished the week with Thursday’s release of April’s existing home sales report. Sales of existing homes fell by 17.8 percent during the month, slightly better than expectations for a 19.9 percent decline. This is the largest monthly decline since July 2010, highlighting the pressure that lockdowns across the country put on the housing market. This disappointing result broke a 9-month streak of year-over-year existing home sales growth. Home sales were one of the bright spots in the second half of 2019 and the start of 2020, so this sudden collapse is disappointing but not surprising, given the effects of shelter-in-place orders during the month.

| Equity Index | Week-to-Date | Month-to-Date | Year-to-Date | 12-Month |

| S&P 500 | 3.27% | 1.67% | –7.77% | 6.84% |

| Nasdaq Composite | 3.48% | 5.02% | 4.36% | 23.53% |

| DJIA | 3.43% | 0.78% | –13.40% | –1.63% |

| MSCI EAFE | 3.01% | –0.71% | –18.43% | –8.57% |

| MSCI Emerging Markets | 0.48% | –2.03% | –18.29% | –5.70% |

| Russell 2000 | 7.87% | 3.54% | –18.29% | –8.34% |

Source: Bloomberg, as of May 22, 2020

| Fixed Income Index | Month-to-Date | Year-to-Date | 12-Month |

| U.S. Broad Market | 0.35% | 5.23% | 9.99% |

| U.S. Treasury | –0.22% | 8.69% | 12.55% |

| U.S. Mortgages | –0.03% | 3.48% | 6.90% |

| Municipal Bond | 1.04% | 1.03% | 4.20% |

Source: Morningstar Direct, as of May 22, 2020

What to Look Forward To

We started the week with Tuesday’s release of the Conference Board Consumer Confidence Index for May. Confidence rose from a downwardly revised 85.7 in April to 86.6 in May. This result was slightly worse than expectations for an increase to 87, but it is still a step in the right direction. Confidence stabilizing as the country begins to reopen indicates that consumers are likely optimistic that the reopening efforts will be successful as we head into the summer. Consumer expectations for the future increased during the month; however, views of the present condition worsened modestly. Overall, this was a largely positive report, as it indicates that consumer confidence may have bottomed in April and could be set to rebound as states reopen. This will continue to be a widely monitored data report, as hopes of a swift economic recovery largely rely on a quick rebound for consumer confidence and spending.

Tuesday also saw the release of April’s new home sales report. New home sales came in much better than expected, increasing modestly from a downwardly revised annual rate of 619,000 in March to 623,000 in April, against forecasts for a fall to 480,000. Despite this better-than-expected performance during the month, the pace of new home sales is still down notably from the recent high of 717,000 set in January. Last year saw strong growth in new home sales, and this momentum continued into the start of 2020 before the pandemic hit. Looking forward, the slowdown in new home construction in March and April will likely serve as a headwind for future new home sales due to lowered supply in key markets.

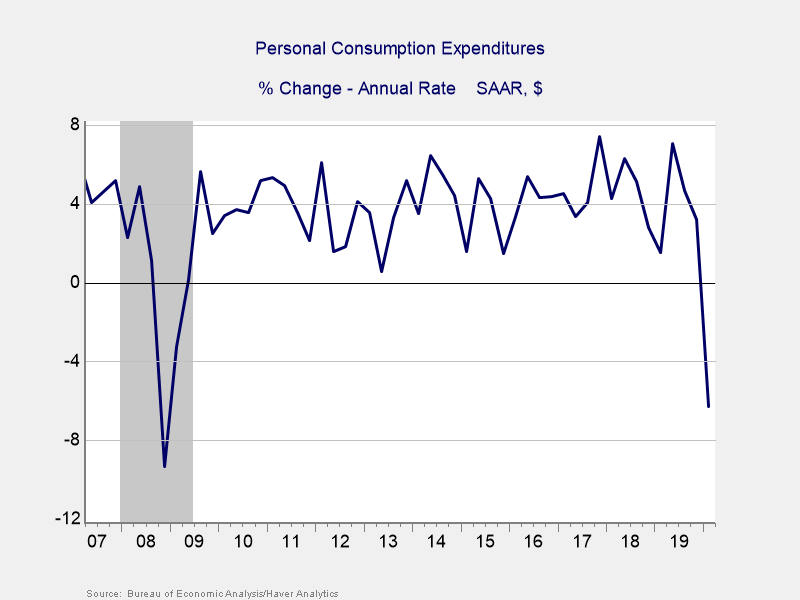

On Thursday, the second estimate of first-quarter gross domestic product (GDP) growth is set to be released. Economists expect to see the annualized growth rate for the quarter remain unchanged at –4.8 percent. Personal consumption, which was the major driver of GDP growth in 2019, is expected to improve slightly to a 7.4 percent annualized decline during the quarter, from an initial estimate of a 7.6 percent decline. Even if this anticipated improvement in consumption holds true, this would still represent the worst quarter for personal consumption since the second quarter of 1980. Although these very weak growth figures are concerning, they are likely just the tip of the iceberg, as economists are currently forecasting a 33.5 percent annualized contraction for the economy in the second quarter.

Thursday will also see the preliminary estimate of durable goods orders in April. Orders are set to decline by 18 percent in April following a 14.7 percent drop in March. Much of the March drop in headline orders was due to a sharp decline in volatile aircraft orders; however, that is not expected to be the case in April. Core durable goods orders, which strip out the effect of volatile transportation orders, are expected to fall by 15 percent during the month, significantly worse than the modest 0.4 percent decline we saw in March. Core durable goods orders are often used as a proxy for business investment. So, if estimates hold, it would indicate that already weak business spending in the first quarter only worsened to start the second quarter.

The third major data release on Thursday will be the weekly initial jobless claims report for the week ending May 23. Economists currently expect 2 million additional Americans filed initial claims during the week. Depending on the revision to the prior week’s report due to the Massachusetts reporting error, this result may end up being a slight increase in initial filings during the week if estimates hold. As we’ve seen over the past two weeks, however, this data is certainly not perfect, and it’s important not to place too much emphasis on week-to-week changes. Rather, the focus should be on the general trend, which has been downward for the past seven weeks, indicating that the worst is likely behind us. We will continue to monitor this weekly update until we see sustained progress in getting weekly initial claims closer to historical levels.

On Friday, April’s personal income and personal spending reports are set to be released. Both of these reports are expected to show historically bad results for the month. Incomes are set to fall by 7 percent, while spending is expected to decline by 12.6 percent. If estimates prove to be accurate, this would be the worst month for both reports on record. While the sharp drop in spending is certainly concerning, the anticipated income decline is also worrisome, as it could hinder a return to faster spending growth as states begin to reopen. April’s retail sales report came in worse than expected, and a similar result for personal spending would serve to reemphasize the damage that the measures to combat the spread of the coronavirus had on the economy during the month.

Finally, we’ll finish the week with Friday’s release of the second and final estimate of the University of Michigan consumer sentiment survey for May. Economists expect to see the index remain unchanged at month-end, remaining in line with the midmonth estimate of 73.7. If this initial result holds, it would represent a slight improvement from April’s final reading of 71.8, driven by a noted improvement in the current conditions subindex, which rose from 74.3 in April to 83 at the start of May. As is the case with the Conference Board report on consumer confidence, this will be a widely followed release as it will give a glimpse into how consumers are reacting to the easing of shelter-in-place orders as we head into the summer.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg Barclays US Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg Barclays US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg Barclays US Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2020 Commonwealth Financial Network ®