Presented by Mark Gallagher

General Market News

• Last week saw a moderate steepening of the yield curve as lawmakers moved closer to a potential stimulus package and the Moderna vaccine was approved. The 10-year Treasury yield opened the week at 0.93 percent and closed just shy of 0.95 percent. This morning, it opened just below 0.90 percent, down 3 basis points (bps) from last week’s open. The 30-year opened this morning at 1.64 percent, a loss of 3 bps from last week’s open of 1.67 percent. On the shorter end of the curve, we saw a sizable move as the 2-year opened last week at 0.121 percent and rose one-fifth of a basis point to 0.123 percent this morning. The bond market signals investors were cautiously optimistic heading into the weekend.

• All three major U.S. indices were up last week, with the Nasdaq leading the way, rising more than 3 percent. Investors sought out large-cap and technology-oriented stocks as case counts continued to rise, particularly in California. The market appeared to have taken a pause from the reopening rally on the large-cap side. Small-cap stocks performed roughly in line with their Nasdaq counterparts, as additional aid is expected with the impending stimulus package. Top-performing sectors last week were technology, consumer discretionary, and materials. Underperforming sectors were energy, communication services, and industrials.

• On Wednesday, the November retail sales report was released. Headline sales came in below expectations, declining by 1.1 percent against forecasts for a 0.3 percent decline. October’s report was also downwardly revised to a 0.1 percent decline. This is the first time since March and April we have seen retail sales decline in consecutive months. Core retail sales, which strip out the impact of volatile auto and gas sales, fell by 0.8 percent during the month against calls for a 0.1 percent increase. October’s core retail sales report was also downwardly revised to show a decline of 0.1 percent. This is a concerning outcome for sales and the overall economic recovery, as consumer spending accounts for the majority of economic activity in the country. Unfortunately, it appears the worsening public health situation and the delay in passing additional federal stimulus have taken an increasing toll on the economic recovery.

• Wednesday saw the release of the National Association of Home Builders Housing Market Index for December. This measure of home builder confidence fell from 90 in November to 86 in December, against calls for a more modest decline to 88. Despite the larger-than-expected decline, the index still sits at its second-highest level on record, highlighting the continued strength of the housing market. Home builder confidence has risen notably since reaching a lockdown-induced low of 30 in April, driven by record-low mortgage rates that have spurred additional prospective homebuyers into the market. The supply of homes available for sale also remains near record lows, another tailwind for home builder confidence.

• The third major release on Wednesday was the Federal Open Market Committee rate decision from the Federal Reserve’s (Fed’s) December meeting. As expected, the Fed did not change the federal funds rate, which was lowered to virtually 0 in March to support a faster economic recovery. The major focus from this meeting was a change in the language for the Fed’s current bond buying program. The Fed reemphasized its commitment to the current purchases of at least $120 billion in assets per month until “substantial further progress” is made on the central bank’s unemployment and inflation goals. This was widely seen as a dovish move meant to support markets and the economy over the short to intermediate term. In a news conference, Fed Chair Jerome Powell doubled down on the continued support for ongoing asset purchases, with the head of the central bank indicating the Fed is ready to do more to support the economic recovery, as needed.

• On Thursday, November’s building permits and housing starts reports were released. Both measures of new home construction showed faster growth than expected, with starts rising by 1.2 percent against forecasts for 0.3 percent growth, while permits increased by 6.2 percent against calls for a 1 percent rise. These strong results brought the pace of permits to its highest level since 2006, while starts remain well above levels seen throughout most of 2019. The pace of single-family housing starts hit a 13-year high in November, driven by shifting consumer preference toward single-family housing. Given the record level of home builder confidence we saw in November, it’s not surprising the pace of new home construction continued to improve during the month; nonetheless, it was an encouraging reminder that the housing market remained healthy despite November’s worsening public health picture.

| Equity Index | Week-to-Date | Month-to-Date | Year-to-Date | 12-Month |

| S&P 500 | 1.29% | 2.51% | 16.88% | 17.86% |

| Nasdaq Composite | 3.07% | 4.61% | 43.41% | 44.83% |

| DJIA | 0.46% | 1.96% | 8.19% | 8.81% |

| MSCI EAFE | 2.01% | 3.83% | 6.98% | 7.74% |

| MSCI Emerging Markets | 0.89% | 5.31% | 16.06% | 17.12% |

| Russell 2000 | 3.09% | 8.33% | 19.60% | 19.80% |

Source: Bloomberg, as of December 18, 2020

| Fixed Income Index | Month-to-Date | Year-to-Date | 12-Month |

| U.S. Broad Market | –0.08% | 7.12% | 7.27% |

| U.S. Treasury | –0.35% | 7.66% | 7.74% |

| U.S. Mortgages | 0.19% | 3.78% | 4.01% |

| Municipal Bond | 0.12% | 5.08% | 5.18% |

Source: Morningstar Direct, as of December 18, 2020

What to Look Forward To

On Tuesday, the Conference Board Consumer Confidence Index for December will be released. This widely monitored gauge of consumer sentiment is expected to increase from 96.1 in November to 97.8 in December, which would mark a rebound. The index would, however, sit at a lower level than the post-lockdown high of 101.4 in October. Historically, improving consumer confidence has supported faster spending growth, so any improvement to end the year would certainly be a welcome sign. With that said, the index is expected to remain well below this year’s high-water mark of 132.6, set in February. We have a long way to go to get consumer confidence back to pre-pandemic levels.

Tuesday will also see the release of the November existing home sales report. Sales of existing homes are expected to fall by 2.2 percent during the month, following a surprise 4.3 percent increase in October. October’s result brought the pace of existing home sales to its highest level since 2005, so the anticipated decline in November is not a major concern. Existing home sales account for the majority of home sales and, since initial lockdowns were lifted, the pace of sales has increased notably. On a year-over-year basis, existing home sales are expected to show a 25.9 percent increase. Looking forward, low supply and rising prices may serve as a headwind to faster housing sales growth. Still, record-low mortgage rates and high levels of home buyer demand are expected to keep the overall pace of sales high for the time being.

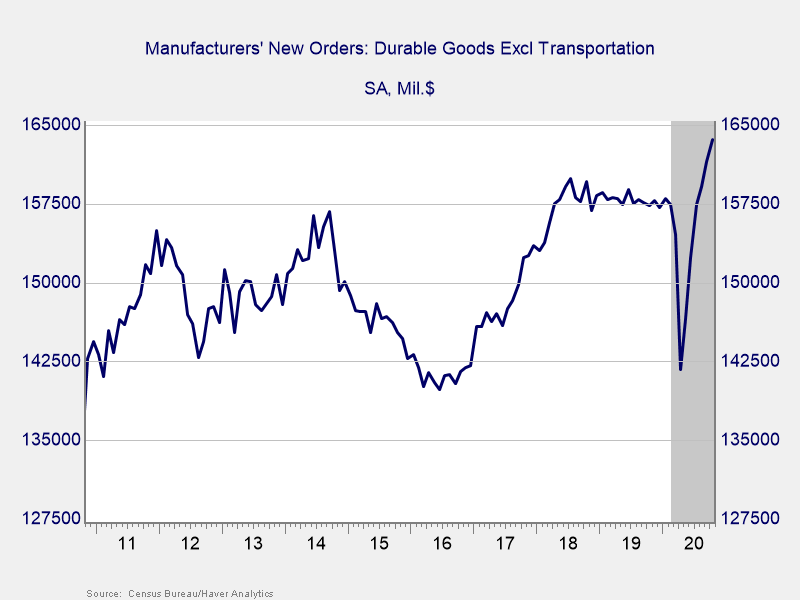

On Wednesday, the preliminary estimate of November’s durable goods orders report is set to be released. Durable goods orders are expected to rise by 0.6 percent during the month, following a 1.3 percent increase in October. Core durable goods orders, which strip out the impact of volatile transportation orders, are expected to rise by 0.5 percent, following a 1.3 percent increase in October. Core durable goods orders are often viewed as a proxy for business investment. Since initial lockdowns ended, we have seen a solid recovery in core orders that surpasses pre-pandemic levels. Business confidence and spending have largely remained resilient through this third wave of infections. A positive result for durable goods orders would be another sign that the business recovery has continued, despite the headwinds created by the pandemic.

The initial jobless claims report for the week ending December 19 will also be released on Wednesday. Economists expect to see a decline in initial claims during the week, with forecasts calling for a drop from 885,000 claims to 863,000. If estimates prove accurate, the result would be a modest improvement from the week before, but the pace of lost jobs would continue at a concerning rate. Given the rise in initial claims this month and the slow pace of hiring in November, it is quite possible we could see a net loss of jobs during December. That result would mark the first net negative month for jobs since initial lockdowns ended in April. Ultimately, to achieve a full economic recovery, we will need to do a much better job of getting people back to work. This weekly release gives us a relatively up-to-date look at the health of the job market, so it will continue to be widely monitored.

Wednesday will also see the release of the November personal spending and personal income reports. Spending is expected to decline by 0.1 percent during the month, down from a 0.5 percent increase in October. If estimates hold, the result would mark the first month with declining spending since April. This decline would echo the drop in November’s retail sales report. Personal income is expected to show a 0.3 percent decline during the month, marking two consecutive months with declining income. Income growth has been very volatile on a month-to-month basis due to shifting government stimulus and unemployment payments. The decline in personal income is expected, due in large part to expiring emergency unemployment payments. We can hope that a second round of federal stimulus payments will support income growth, but the next round of payments is likely to come in early 2021. In the meantime, we may see further declines in income in December given the continued stress on the labor market.

The fourth major data release on Wednesday will be the release of the second and final estimate for the University of Michigan consumer sentiment index for December. The initial estimate showed a surprise increase for the index, from 76.9 in November to 81.4 to start December. Economists expect to see the index fall to 80.9 at month-end. While an intramonth decline would be slightly disappointing, it would leave the index near the post-lockdown high of 81.8 set in October. In addition, the index would remain well above the low of 71.8 it hit in April, suggesting that consumers are reacting to the third wave of infections with more resilience than earlier in the year.

Finally, we will finish the week with Wednesday’s release of the new home sales report for November. New home sales are expected to decline by 0.9 percent during the month, following a 0.3 percent drop in October. Despite the anticipated decline, the pace of new home sales would remain near its highest level since 2006. New home sales are a smaller and often more volatile component of total sales compared with existing home sales, but this segment has rebounded notably since initial lockdowns ended. On a year-over-year basis, new home sales are expected to grow by 42.2 percent in November. As with existing home sales, low supply and high prices may serve as a headwind to faster sales growth going forward. Still, continued sales near current levels would highlight the strength of the housing market and be a positive sign for overall economic growth.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg Barclays US Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg Barclays US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg Barclays US Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2020 Commonwealth Financial Network®