Presented by Mark Gallagher

Markets Rebound in January

Markets rallied to start the year, with all three major U.S. indices seeing positive returns in January after experiencing declines in 2022. The S&P 500 rose 6.28 percent, the Dow Jones Industrial Average rose 2.93 percent, and the technology-heavy Nasdaq Composite led the way with a strong 10.72 percent gain. Equity markets were supported by falling long-term interest rates.

These positive returns came despite weakening fundamentals. Per Bloomberg Intelligence, as of January 31, 2023, with 45 percent of companies having reported actual earnings, the average earnings decline for the S&P 500 in the fourth quarter of 2022 was 2.3 percent. Although this is slightly better than the 3.3 percent decline forecasted at the start of earnings season, if earnings decline for the fourth quarter, it would represent the first quarter with a year-over-year decline since the third quarter of 2020. Analysts are currently forecasting continued earnings declines in the first half of 2023 as well. Fundamentals drive long-term market performance, so the weakness in earnings should be monitored.

While fundamentals were not supportive, technical factors were another story. All three major U.S. indices ended the month above their respective 200-day moving averages, which marked the first month that all three have finished above trend since December 2021. The 200-day moving average is a widely monitored technical indicator, as prolonged breaks above or below trend can signal shifting investor sentiment for an index. Although a one-month trend is not enough to say that investors are now bullish on U.S. equities, technical support to start the year was still an encouraging sign for investors.

The story was similar with international markets in January. The MSCI EAFE Index of developed international companies gained 8.10 percent while the MSCI Emerging Markets Index increased 7.91 percent. Falling interest rates and reopening efforts in China helped support international stocks to start the year. Technical factors were also supportive during the month, as both the developed and emerging market indices finished the month above their respective 200-day moving averages. This represents the first time that the MSCI Emerging Markets Index has finished a month above trend since June 2021.

Bond markets also had a strong start to the year. Long-term rates fell in January, as the 10-Year U.S. Treasury yield declined from 3.88 percent at the end of December to 3.52 percent at the end of January. This helped support bond prices as the Bloomberg U.S. Aggregate Bond Index gained 3.08 percent. High-yield bonds were also up to start the year. The Bloomberg U.S. Corporate High Yield Bond Index gained 3.81 percent in January. High-yield credit spreads tightened, which indicates that investors grew more comfortable with taking on additional credit risk at lower yields.

Falling Rates Support Markets

The solid start to the year for investors was due in large part to declining interest rates during the month. The drop in rates was in turn driven by signs of slowing inflation and expectations for slower rate hikes this year. Headline producer and consumer prices both declined in December, with the monthly drop in prices supporting slowing year-over-year price growth. Inflation is high on a year-over-year basis, but the December price reports showed encouraging signs of declining price pressure across the economy. Economist and consumer forecasts call for continued slowing inflation throughout the year, which is another positive sign that efforts to contain price growth are paying off.

Cooling inflation helped support increased investor expectations for a slowdown in the pace of Federal Reserve (Fed) rate hikes in 2023 compared to 2022. Futures markets project one additional 25 basis point (bp) hike this year following the 25 bps hike in February and the 4.25 percent of rate hikes we saw in 2022. If expectations prove to be accurate, it would represent a notable slowdown in the pace of rate hikes.

Economic Growth Slows

While the slowdown in inflation was a good sign for the economy and investors, other economic data reports released during the month showed signs of a continued economic slowdown. Consumer spending fell for the second consecutive month to end 2022, and business confidence and investment also slowed at year-end. Given the signs of economic slowdown, it’s possible that we’ll enter a recessionary environment at some point this year. That said, if we do see a recession in 2023, it’s expected to be mild.

Job growth remained strong at the end of 2022, which should help support the economy in the case of a potential recession. Consumer confidence also showed signs of improvement toward the end of last year and start of this year. The University of Michigan consumer sentiment index finished January at its highest level since April 2022, signaling increased consumer optimism to start the year. Improved consumer sentiment has historically supported consumer spending growth, so this confidence is another encouraging signal that economic fundamentals are relatively healthy despite the recent slowdown.

Additionally, a further slowdown in economic growth could encourage the Fed to keep rate hikes this year to a minimum, which would again support markets. Ultimately, while no one roots for a recession, relatively healthy economic fundamentals indicate that a recession in 2023 would likely be mild and could benefit investors and the economy in the long run.

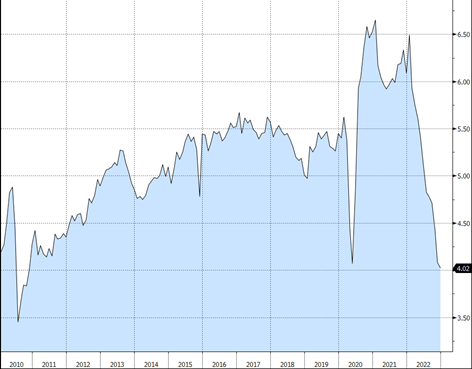

One sector that’s seen a notable slowdown already is the housing sector. Housing sales continued to fall at year-end, due to high prices and mortgage rates along with a lack of supply of homes for sale. As you can see in Figure 1, the annualized pace of existing home sales fell throughout the course of last year, with the December result bringing the pace of sales to its lowest level since 2010. The housing sector will be important to monitor going forward as housing costs make up a large portion of consumer inflation. The slowdown in housing sales has been challenging for prospective home sellers over the past year. We started to see signs of declining housing prices toward year-end, however, which could help support slower inflation later this year if the trend continues.

Figure 1. Total Existing Home Sales, Seasonally Adjusted Annualized Rate, 2010–Present

Risks Remain

It was a positive start to the year for investors, but there are very real market risks to monitor. The primary risk here in the U.S. is political, as the debt ceiling confrontation is set to drive uncertainty for markets and the economy until it’s resolved. While we’ve seen similar standoffs in the past that have been resolved before a potential government default, this process could play out over the course of several months and markets would likely face additional volatility if a compromise cannot be reached in a timely manner. Investors will also be keeping an eye on equity fundamentals given the expected earnings decline in the fourth quarter and analyst forecasts for continued earnings declines in the first half of 2023.

International risks should also be monitored as uncertainty overseas remains. Even though the direct market impact from the Russian invasion of Ukraine declined throughout 2022, the continued conflict could lead to further flare ups and uncertainty for the region and investors. Additionally, China’s efforts to reopen its economy bear watching, as any slowdown in the reopening process could spook investors.

It’s also important to remember that other risks might materialize and negatively impact markets at any time. Last year was a good example of the impact that unknown risks present, as the Russian invasion of Ukraine and the surge in inflation year drove investors across asset classes into the red. The market impact from those risks diminished but serve as a reminder that we may see further turbulence ahead.

Ultimately, there are a number of risks for investors as we kick off 2023. On the whole, however, the picture is relatively positive. While there is certainly the potential for short-term market turbulence in the months ahead, the relatively solid economic backdrop should help support long-term performance. Given the prospects for more short-term uncertainty, a well-diversified portfolio that matches investor goals with timelines remains the best path forward for most. As always, you should reach out to your financial advisor to discuss your current plan if you have concerns.

All information according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com

Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, manager, fixed income, at Commonwealth Financial Network®.

© 2023 Commonwealth Financial Network®