Presented by Mark Gallagher

General market news

- After being as high as 2.39 percent, the yield on the 10-year Treasury moved lower late last week, opening at 2.30 percent on Monday. Some weaker-than-expected economic data, combined with what seemed to be more dovish comments from Federal Reserve (Fed) Chair Janet Yellen, helped push rates lower. The 30-year yield remains below 3 percent at 2.89 percent, and the 2-year is back below 1.4 percent, the lowest it has been since 2009.

- The Nasdaq Composite regained its leadership position last week following a post-July 4 slump. It led the three major U.S. indices with a gain of 2.59 percent. The S&P 500 and Dow Jones Industrial Average gained 1.42 percent and 1.04 percent, respectively. Markets reacted positively to Yellen’s semiannual testimony before Congress and her remarks that lower levels of inflation may lead the Fed to raise rates more slowly in the future.

- The technology and energy sectors performed best on the week. Technology benefited from the Fed’s pro-growth stance, while energy benefited as oil prices recovered to $46.35 per barrel. The worst-performing sectors were telecom and financials. Despite beating earnings estimates, big bank stocks JPMorgan Chase, Wells Fargo, and Citigroup all fell. A lower net interest income forecast from JPMorgan, a revenue miss for Wells Fargo, and lower net income for Citigroup were seen as reasons for the decline. As earnings season shifts into high gear this week, we could see an increase in market volatility.

- In economic news, we saw a number of data points surrounding inflation last week. On Thursday, Producer Price Index data came in slightly weaker than expected. The core figure, which excludes more volatile energy and food prices, increased 0.1 percent against expectations of a 0.3-percent gain. Year-over-year, prices have increased 1.9 percent against expectations for 2.1-percent growth. On Friday, Consumer Price Index data also came in slightly weaker than expected. Core prices grew 0.1 percent month-over-month against expectations for 0.2-percent growth. Year-over-year, this measure remained at 1.7 percent.

- Retail sales data for June also came in worse than expected despite continued high levels of confidence. Both the headline and core figures disappointed, declining slightly against expectations for modest growth. Continued consumer optimism has failed to translate into consistent sales growth, so this measure will bear watching.

| Equity Index | Week-to-Date | Month-to-Date | Year-to-Date | 12-Month |

| S&P 500 | 1.42% | 1.56% | 11.05% | 16.04% |

| Nasdaq Composite | 2.59% | 2.82% | 18.01% | 26.97% |

| DJIA | 1.04% | 1.43% | 10.91% | 19.91% |

| MSCI EAFE | 2.38% | 1.91% | 16.40% | 19.77% |

| MSCI Emerging Markets | 4.60% | 3.99% | 23.29% | 24.12% |

| Russell 2000 | 0.93% | 0.98% | 6.01% | 20.49% |

Source: Bloomberg

| Fixed Income Index | Month-to-Date | Year-to-Date | 12-Month |

| U.S. Broad Market | –0.40% | 2.36% | –0.51% |

| U.S. Treasury | –0.59% | 1.80% | –2.33% |

| U.S. Mortgages | –0.39% | 1.51% | 0.07% |

| Municipal Bond | –0.36% | 3.73% | –0.31% |

Source: Morningstar Direct

What to look forward to

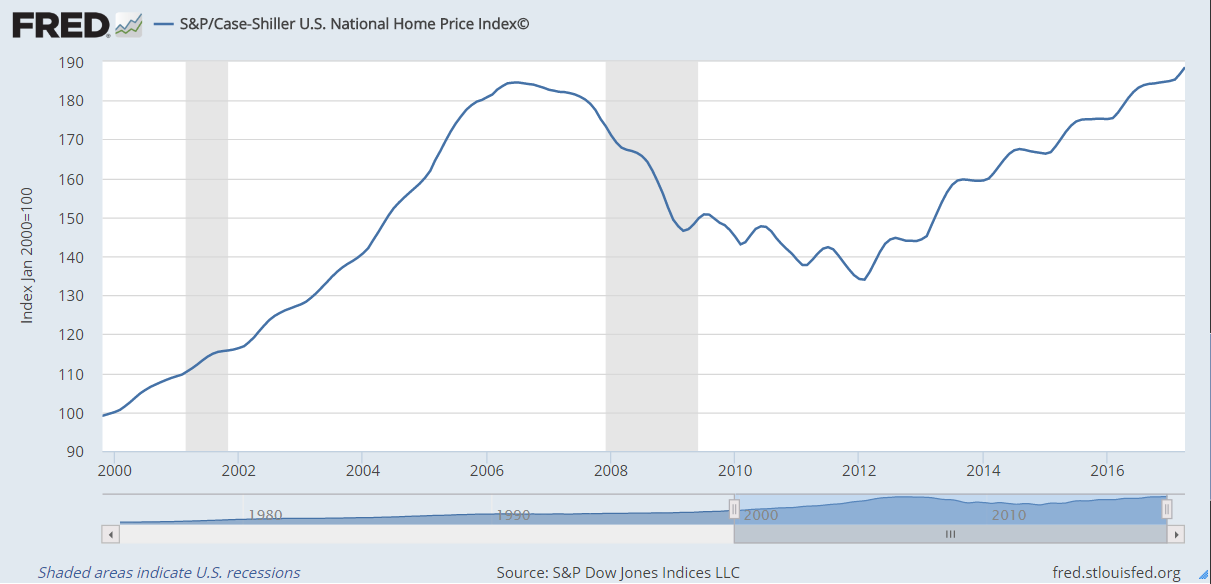

This week is a quiet one for economic news, with only housing data on tap.

On Tuesday, the National Association of Home Builders industry confidence survey will be released. It’s expected to increase from 67 to 68. This is a very high level of confidence, not far off the 12-year high of 71 set in March of this year. If it comes in as expected, the result would suggest that industry confidence continues to be supported by low levels of available inventory and high demand.

Housing starts, released on Wednesday, are expected to ratify that confidence, rising from 1.092 million in May to 1.18 million in June. This would represent only a partial rebound from the drop in May, but there is some downside risk, as building permit issuance has declined recently. Housing starts are actually down on a year-to-year basis, so a significant bounce back would be a positive indicator for the economy as a whole.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg Barclays US Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg Barclays US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg Barclays US Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million.

###

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2017 Commonwealth Financial Network®