Presented by Mark Gallagher

Mixed Month for Markets

Equity market returns were mixed in November as concerns about the COVID-19 Omicron variant led to late-month declines that largely wiped out earlier gains. The S&P 500 declined 0.69 percent while the Dow Jones Industrial Average (DJIA) experienced a 3.50 percent decline. The Nasdaq Composite held up the best during the month and was able to eke out a 0.33 percent return.

These mixed results came despite improving fundamentals. According to Bloomberg Intelligence, as of November 24, 2021, the average earnings growth rate for the S&P 500 in the third quarter was 40.9 percent. This is up from the 37.5 percent reported growth rate we saw at the end of October and well above analyst estimates for a 28.4 percent growth rate at the start of earnings season. Clearly, businesses have continued to successfully adapt to operating in a post-lockdown environment, which is a positive sign for future market returns, as fundamentals drive market performance over the long term.

Technical factors were also supportive for markets. All three major U.S. equity markets finished the month above their respective 200-day moving averages, although late-month volatility caused the DJIA to approach its trendline. The 200-day moving average is an important technical factor, with prolonged breaks above or below this level signaling a shift in investor sentiment for an index. All three indices have remained above trend throughout the year, which indicates investors remain confident in the ongoing economic recovery and prospects for U.S. markets.

The story was similar internationally, with late-month declines leading to negative returns for foreign markets in November. The MSCI EAFE Index saw a 4.65 percent decline while the MSCI Emerging Market Index dropped 4.07 percent. Technicals for international markets were not supportive, as both indices finished the month below their respective 200-day moving averages. This was the first time that the MSCI EAFE Index has ended a month below trend since June 2020, so it will be an important area to monitor in the months ahead to see if investor sentiment has soured for developed international equities.

Fixed income markets had a mixed month as well. Rising investor concerns toward the end of the month led to a flight to safety that lowered yields for higher-quality bonds but caused high-yield spreads to widen. The 10-year U.S. Treasury yield fell from 1.58 percent at the start of the month to 1.43 percent at month-end. The Bloomberg U.S. Aggregate Bond Index gained 0.30 percent. The Bloomberg U.S. Corporate High Yield Index, which is typically less sensitive to interest rate changes and more aligned with moves in equity markets, declined 0.97 percent in November.

Medical Risks Rise with Omicron

Public health focus was on the discovery of the new Omicron variant of the COVID-19 virus. The new variant caused increased investor concern and contributed to the late-month sell-off but did not cause case growth to surge to concerning levels. While average case growth did rise modestly from October to November, the number of daily new cases remains well below the recent peak we saw from the Delta variant in August and early September.

Looking forward, it’s possible we will continue to see an increase in new cases to finish out the year. We remain better able to handle an increase now than earlier in the pandemic, however, due to the continued increases in vaccination rates. We ended the month with more than 58 percent of the population fully vaccinated against COVID-19 and an additional 11 percent of people who have received at least one shot. With rising concerns about the new variant, it’s likely that we will see a continued uptick in vaccinations in the months ahead, which should help mitigate the impact of the new strain.

Overall, while health risks did increase during the month, we remain in a much better place on the public health front than even a few months ago. Although caution is warranted given the unpredictable nature of the virus, the current impact from the Omicron variant remains muted compared to the Delta variant.

Economic Recovery Continues

Even if we do see an Omicron wave, having weathered two Delta waves has already made the economy more resilient, and any economic damage would likely be constrained. Right now, the economic data keeps getting better. For example, one of the month’s highlights was the release of the October job report, which saw 531,000 jobs added and marked the best month for job growth since July. On top of that, the initially lackluster job growth for both August and September was revised upward. Although the November report came in below expectations, it will likely be revised upward based on the stronger household survey data. In any event, the monthly average job growth remains above 500,000 for 2021. The labor market is a key indicator for the pace of the overall economic recovery, so strong hiring during the Delta wave of COVID-19 suggests that the recovery will be resilient to any Omicron wave.

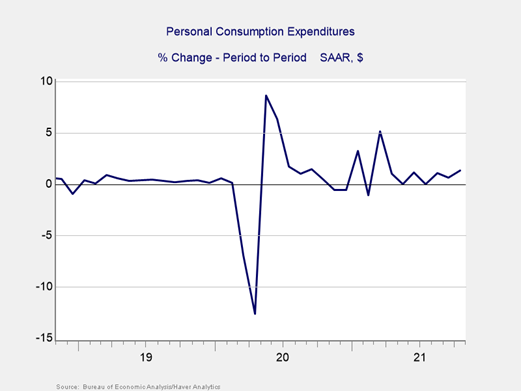

Another factor supporting growth is the strength of consumer spending, which continued to surprise for both retail sales and personal spending. Consumer spending drives economic activity in the country, so these better-than-expected results were another positive sign for the pace of the overall recovery. As you can see in Figure 1, November marked eight consecutive months with personal spending growth and was the best month since March (throughout the Delta waves).

Figure 1. Personal Consumption Expenditures

Business spending also remained solid during the month, supported by record-high levels of business confidence. Core durable goods orders, which are a proxy for business investment, increased 0.5 percent in October, marking eight straight months with increased core durable goods orders (again, through the Delta waves). Business confidence and spending have been supported by the easing of state and local restrictions throughout much of the year. The continued improvement in October was an encouraging sign that businesses remain willing and able to invest to try to meet high levels of pent-up consumer demand.

The housing sector also showed continued signs of improvement during the month, including a larger-than-expected increase in existing home sales in October that brought the pace of sales to a nine-month high. This improvement came despite low levels of supply of homes for sale coupled with rising mortgage rates. The encouraging result highlights the continued strength of the housing sector and indicates home buyer demand remains strong heading into the end of the year.

Medical and Policy Risks Remain

While economic recovery continued during the month, risks are very much still in play, with medical and policy being the two most significant. On the medical side, although the risks are contained, they certainly bear watching. On the policy side, the risks are only starting to become apparent and will likely rise by year-end.

The most immediate policy risk is politics, starting with the debt ceiling confrontation. While a stopgap measure that will keep the government operating through February has been signed, the issues have not gone away and it will continue to be disruptive. That said, however, we have seen this movie before—and it’s likely we will again see some sort of resolution before a shutdown becomes necessary—but the uncertainty created by the situation has the potential to negatively impact markets and the pace of the economic recovery. Beyond that, the economy also faces uncertainty amid continued negotiations surrounding the Build Back Better Act.

In terms of monetary policy, the Federal Reserve (Fed)’s decision to start tightening policy will play out over the coming months but is becoming a headwind now. Chair Jerome Powell rocked markets at month-end when he indicated during Senate testimony that the Fed may tighten policy faster than expected. While faster tightening is a good sign in that it means the Fed sees the economy as healthy, it could cause further market volatility in the months ahead.

International risks are also very real, notably in the recent slowdown in Chinese growth and concerns about the country’s troubled property development sector. While these factors are not expected to lead to a global financial crisis, they should be watched given the potential to drive additional uncertainty and slow the pace of the global economic recovery.

While we have very real medical and political risks, the economy continues to show substantial momentum despite these rising headwinds. We remain in a much better place on the public health and economic fronts than earlier in the year, and the most likely path forward is continued growth ahead.

That being said, the rising risks and market turbulence in November are a reminder that the road back to normal will be long and that we may experience setbacks along the way. As always, a well-diversified portfolio that matches investor goals and timelines remains the best path forward for most. If concerns remain, you should speak to your financial advisor about your financial plan.

All information according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2020 Commonwealth Financial Network®