Presented by Mark Gallagher

General Market News

• The 10-year Treasury yield opened at 0.68 percent on Monday, while the 30-year opened at 1.44 percent and the 2-year at 0.15 percent. The 10-year and shorter part of the yield curve remain lower as uncertainty and near-term concerns about the economy linger. Meanwhile, the 10- to 20-year portion of the curve has become steeper, as there has been an influx of new supply.

• With a number of economic measures helping fuel optimism in the economy, U.S. equities held a strong rally last week in the face of rising COVID-19 cases. As we will cover below, June’s Institute for Supply Management (ISM) Manufacturing index and employment reports surprised to the upside. We also saw positive early study results from a joint effort by Pfizer (PFE) and BioNTech SE (BNTX) to develop a coronavirus vaccine. Lastly, we saw the release of the minutes of the June Federal Open Market Committee (FOMC) meeting, at which the board stated there was a substantial likelihood of additional waves. The FOMC announced it has continued to purchase corporate bonds from names such as AT&T (T), UnitedHealth Group (UNH), and Walmart (WMT). Sectors that outperformed last week included communication services, REITs, and materials. Lagging sectors included financials, energy, and consumer staples.

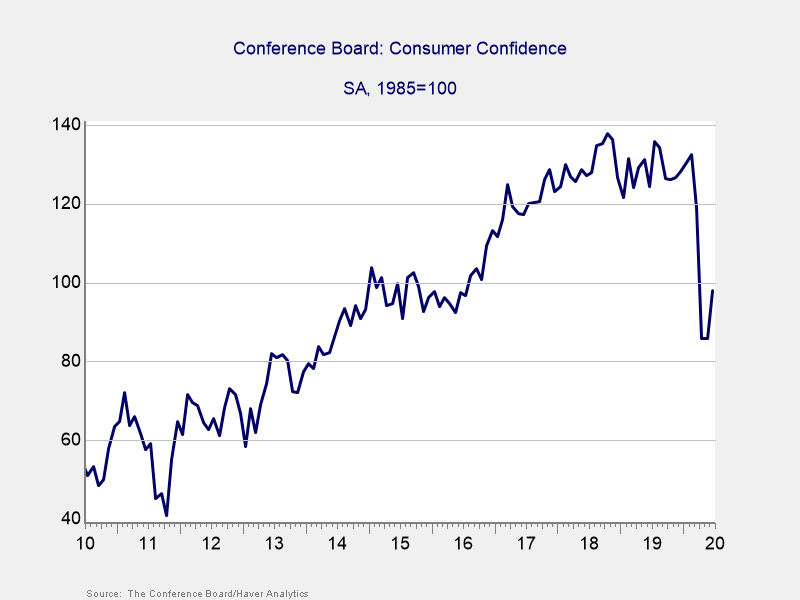

• We started last week with Tuesday’s release of the Conference Board Consumer Confidence Index for June. Confidence rose from 86.6 in May to 98.1 in June, against expectations for a more modest increase to 91.5. This improvement, the best single-month increase for the index since 2011, helps calm concerns about rising case counts affecting consumer confidence. Increased confidence levels support faster consumer spending growth, so this was a very encouraging sign for June’s consumer spending reports and overall economic growth in the second quarter.

• On Wednesday, the ISM Manufacturing index for June was released. This measure of manufacturing sector confidence rose from 43.1 in May to 52.6 in June, against forecasts for a more modest increase to 49.8. This was the largest single-month increase for the index in nearly 40 years, bringing manufacturer confidence to a 14-month high. This is a diffusion index, where values greater than 50 indicate expansion, so this better-than-expected result bodes well for manufacturing output during the month. Many factories began to reopen in late May and early June, boosting confidence after forced closures in April brought the index to its lowest level since the 2008 financial crisis. Ultimately, this result points toward a faster-than-expected recovery for the manufacturing sector, which was hit hard by anticoronavirus measures.

• We finished the holiday-shortened week with Thursday’s release of the June employment report. Approximately 4.8 million jobs were added during the month, far better than economist estimates for slightly more than 3.2 million. This marks the second consecutive month in which headline job creation was far above economist estimates, indicating that once reopening efforts took hold, the pace of economic recovery was faster than expected. The underlying data was positive as well, with the unemployment rate falling from 13.3 percent in May to 11.1 percent in June, against forecasts for a more modest fall to 12.5 percent. The labor force participation rate also increased while the underemployment rate fell. In summary, this was a very strong employment report that showed reopening efforts spurred more hiring than anticipated, and that supports hopes for a faster-than-expected economic recovery.

| Equity Index | Week-to-Date | Month-to-Date | Year-to-Date | 12-Month |

| S&P 500 | 4.07% | 0.98% | –2.13% | 6.57% |

| Nasdaq Composite | 4.64% | 1.49% | 14.35% | 26.22% |

| DJIA | 3.29% | 0.10% | –8.34% | –1.83% |

| MSCI EAFE | 1.48% | 1.37% | –10.13% | –5.19% |

| MSCI Emerging Markets | 3.65% | 3.98% | –6.19% | –0.64% |

| Russell 2000 | 3.90% | –0.65% | –13.54% | –7.57% |

Source: Bloomberg, as of July 2, 2020

| Fixed Income Index | Month-to-Date | Year-to-Date | 12-Month |

| U.S. Broad Market | 0.12% | 6.26% | 8.53% |

| U.S. Treasury | –0.24% | 8.60% | 10.05% |

| U.S. Mortgages | 0.04% | 3.50% | 5.45% |

| Municipal Bond | 0.05% | 2.08% | 4.30% |

Source: Morningstar Direct, as of July 2, 2020

What to Look Forward To

On Monday, the ISM Nonmanufacturing index for June was released. This measure of service sector confidence far surpassed economist estimates, increasing from 45.5 in May to 57.1 in June, against calls for a more modest rise to 50.2. This is another diffusion index, where values above 50 indicate expansion, so this swift rebound after the index hit a 10-year low of 41.8 in April is very encouraging. The service sector accounts for the lion’s share of economic activity, so the rapid recovery in confidence in June is a good sign for the ongoing economic recovery. As we saw with manufacturer confidence, reopening efforts in May and June served as a tailwind for service sector confidence during the month. Ultimately, this report indicates the pace of economic recovery was faster than initially expected once reopening efforts took hold.

On Thursday, we’ll get the initial jobless claims report for the week ending July 4. The level of initial jobless claims has improved for each of the past 13 weeks after hitting an all-time high of more than 6.8 million in the final week of March. Still, despite the continued improvement over three months, the level of weekly initial claims on an absolute basis remains elevated compared with historical norms. Throughout 2019, roughly 220,000 initial claims were made per week; June’s range of 1.4–1.6 million weekly claims is well above normal levels. These numbers indicate continuing pressure on the jobs market despite improvements we’ve seen since the end of March. We’ll continue to monitor this weekly report until the level of initial claim returns closer to normal.

On Friday, the Producer Price Index for June will be released. Economists expect to see producer prices increase by 0.4 percent for the month, following a 0.4 percent increase in May. Nonetheless, headline producer prices are likely to show a modest decline on a year-over-year basis. Core producer prices, which strip out the impact of volatile food and energy prices, are expected to increase by 0.1 percent in June after falling by 0.1 percent in May. Inflationary pressures have been kept at bay over the past few months due to the massive shock to demand created by the pandemic; however, with businesses reopening and producers and consumers starting to spend again, increased inflationary pressure is expected.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg Barclays US Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg Barclays US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg Barclays US Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2020 Commonwealth Financial Network ®