Presented by Mark Gallagher

General Market News

• Rates fell slightly last week, as concerns regarding the spread of the coronavirus continued to rattle investors. The 10-year Treasury yield fell to 1.54 percent to start the week, and the 30-year fell to 1.99 percent.

• Both domestic and emerging markets moved higher last week, while international developed markets remained flat. Utilities and REITs outperformed, supported by concerns about the impact of the coronavirus on global growth. These sectors were followed by consumer discretionary and technology, with the University of Michigan consumer sentiment survey surprising to the upside on Friday. The largest individual contributor was Nvidia, which was up more than 15 percent after beating sales and earnings expectations. Other top contributors included companies with heavy consumer exposure, such as Amazon, Visa, and Mastercard. The worst-performing sectors included materials, energy, and consumer staples.

• On Thursday, January’s Consumer Price Index (CPI) report was released. Consumer prices increased by a modest 0.1 percent during the month, which led to year-over-year growth of 2.5 percent. This is a slight increase from the 2.3 percent year-over-year growth we saw in December. Core CPI, which strips out the impact of volatile food and energy prices, rose by 0.2 percent for the month and 2.4 percent year-over-year. Even with the slight uptick in January, and three Federal Reserve (Fed) interest rate cuts last year, inflation remains modest. Fed board members have indicated they are comfortable with inflation coming in above their stated 2 percent target, so there is no major concern for the time being.

• Friday saw the release of January’s retail sales report. Headline sales grew by 0.3 percent during the month, marking four straight months of sales growth. Excluding volatile auto and gas purchases, the results were even better, with 0.4 percent growth in January. This was above economist estimates for 0.3 percent growth. Sales of building materials and furniture were two of the fastest-growing categories, spurred by mild weather and a strong housing market. Consumer spending was a major driver of gross domestic product growth in 2019, so this strong start to the year is a good sign for the economy as we kick off 2020.

• Friday also saw the release of December’s industrial production report, which came in slightly lower than estimates. Production declined by 0.3 percent during the month, against expectations for a 0.2 percent drop. This decline was caused in large part by a slowdown in utilities output, driven by January’s mild weather. Manufacturing output declined by 0.1 percent in January, which was in line with expectations. This decline was due largely to Boeing’s decision to temporarily halt production on the 737 MAX aircraft, as manufacturing output excluding aircraft rose by 0.3 percent during the month.

• We finished the week with the first reading of the University of Michigan consumer sentiment survey for February. Sentiment increased from 99.8 in January to 100.9 in February, despite forecasts for a slight decline to 99.5. This better-than-expected result brought the index to its highest level in nearly two years. The surprisingly strong January employment report, combined with positive equity markets and a healthy housing market, helped bolster consumer confidence.

| Equity Index | Week-to-Date | Month-to-Date | Year-to-Date | 12-Month |

| S&P 500 | 1.65% | 4.91% | 4.87% | 24.21% |

| Nasdaq Composite | 2.23% | 6.40% | 8.56% | 31.62% |

| DJIA | 1.17% | 4.27% | 3.34% | 16.31% |

| MSCI EAFE | –0.02% | 1.83% | –0.30% | 13.50% |

| MSCI Emerging Markets | 1.37% | 4.16% | –0.70% | 10.11% |

| Russell 2000 | 1.90% | 4.62% | 1.27% | 9.10% |

Source: Bloomberg

| Fixed Income Index | Month-to-Date | Year-to-Date | 12-Month |

| U.S. Broad Market | 0.03% | 1.88% | 9.56% |

| U.S. Treasury | –0.01% | 2.15% | 8.68% |

| U.S. Mortgages | 0.01% | 0.84% | 6.53% |

| Municipal Bond | 0.10% | 1.78% | 8.32% |

Source: Morningstar Direct

What to Look Forward To

We’ll start the week with Monday’s release of the National Association of Home Builders Housing Market Index for February. This gauge of home builder confidence dropped one point, to 74, against expectations to remain steady. The index sits two points below a 20-year high. Home builder confidence has been supported by very strong home buyer demand, as demonstrated by the subindex that tracks prospective buyer traffic, which hit its highest level since 1998 in December. Falling mortgage rates and high consumer confidence have been driving more prospective buyers into the market, though supply continues to be a constraint. Home builders have noticed and ramped up construction accordingly.

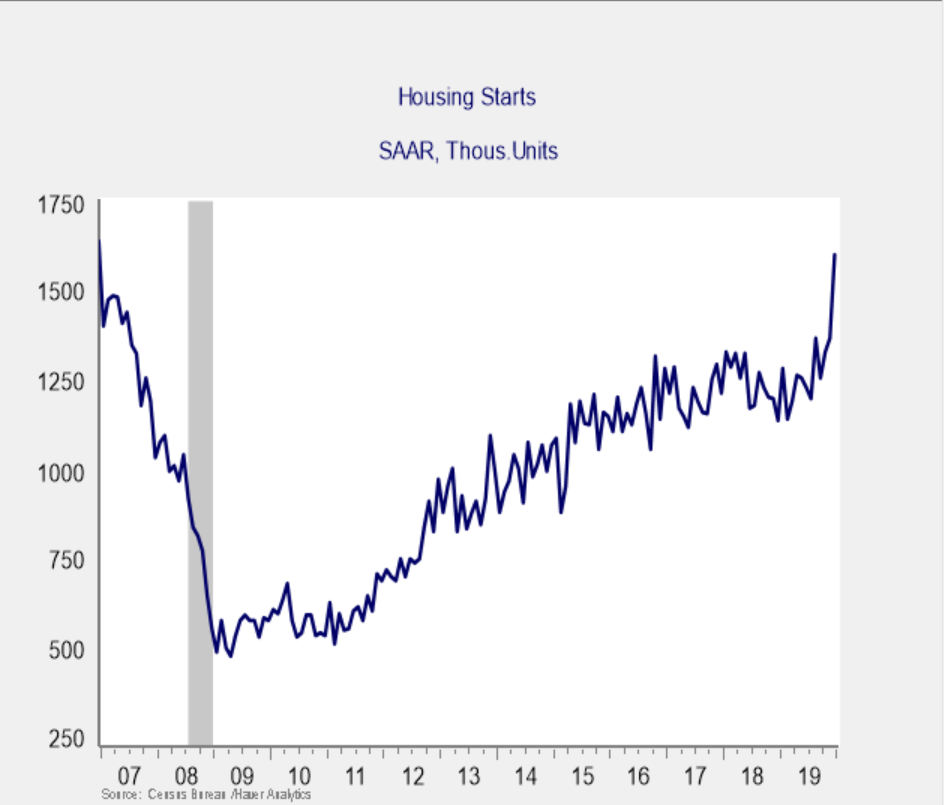

Speaking of construction, on Tuesday, January’s building permits and housing starts reports will be released. Permits are expected to show moderate 2.1 percent growth, while starts are set to decline by 12.9 percent. While this anticipated drop in housing starts is notable, starts can be very volatile on a monthly basis, as evidenced by the 16.9 percent increase seen in December. Despite their tendency to fluctuate, housing starts showed a clear upward trend throughout 2019. Constrained supply and high buyer demand made home builders eager to start new construction as quickly as possible. If the estimates for January are accurate, housing starts will be at their second-highest monthly level since 2006, giving us no cause for concern.

Tuesday will also see the release of January’s Producer Price Index. Producer inflation is slated to increase by 0.1 percent during the month and 1.6 percent year-over-year. Core prices that exclude volatile food and energy prices are set to increase by 0.2 and 1.3 percent for the month and year, respectively. As noted with consumer prices, inflation remains muted despite the Fed’s supportive rate cuts last year. This measure of producer inflation has been below the Fed’s 2 percent target since May 2019.

On Wednesday, the minutes from the January Federal Open Market Committee meeting will be released. The Fed unanimously voted to keep the federal funds rate unchanged. Given this decision, as well as recent testimony from Fed Chairman Jerome Powell to Congress, the minutes are unlikely to contain any major surprises. We may get some commentary regarding the Fed’s plans to unwind its ongoing involvement in the repurchase market. Overall, however, the minutes are expected to give us an insight into the Fed’s views on the current economic expansion rather than revelations.

We’ll finish out the week with Friday’s release of January’s existing home sales report. Economists are forecasting a modest decline of 1.2 percent, following a 3.6 percent gain in December. Despite such a drop, the forecasted result would represent more than 10 percent growth on a year-over-year basis. It would also mark seven straight months with year-over-year growth, demonstrating a very solid turnaround from the prolonged slowdown in sales throughout 2018. Housing’s rebound has been one of the bright spots of the economic expansion, so a continued recovery would be quite welcome.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg Barclays US Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg Barclays US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg Barclays US Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2020 Commonwealth Financial Network ®