Presented by Mark Gallagher

More tricks than treats for markets in October

Unfortunately, October lived up to its scary reputation for the markets. Here in the U.S., all three major indices were down for the month. The Nasdaq Composite fared worst with a 9.16-percent loss. Meanwhile, the S&P 500 and Dow Jones Industrial Average lost 6.84 percent and 4.98 percent, respectively.

Slowing growth and a change in sentiment with regard to large technology companies drove the stock sell-off. The big tech names have been a major driver of returns throughout the year. As such, a pullback here had a disproportionate impact on the broader markets. From a technical perspective, all three indices finished the month below their 200-day moving averages. But a rally at month-end cut losses and moved them back toward the trend line.

Given this partial recovery, there is reason to believe that the sell-off may have been a bit overdone. For example, fundamentals for U.S. companies remain strong. According to FactSet (as of October 26, 2018), with 48 percent of S&P 500 companies reporting, the blended average earnings growth rate was 22.5 percent. This result is an improvement from the beginning of the month, when analysts projected earnings growth of 19.3 percent. In the long run, fundamentals drive performance, so these better-than-expected results are encouraging.

International markets also experienced volatility. The MCSI EAFE Index fell 7.96 percent, and the MSCI Emerging Markets Index declined by 8.70 percent. From a technical perspective, both indices remained well below their 200-day moving averages, as they have for the past few months. Political concerns in Europe and a strengthening dollar contributed to the losses seen in foreign markets.

Even fixed income markets fell in October, albeit for different reasons. The Bloomberg Barclays U.S. Aggregate Bond Index dropped by 0.79 percent, driven by rising interest rates. The 10-year Treasury yield ended September at 3.05 percent. It reached a high of 3.23 percent midmonth, before finishing October at 3.15 percent. This increase was caused in large part by rising inflation concerns.

High-yield fixed income also had a rough start to the quarter. The Bloomberg Barclays U.S. Corporate High Yield Index fell 1.60 percent in October. The high cost of capital and a risk-off stance by investors caused turbulence in this historically volatile asset class.

Slowing economic growth

October’s data painted a picture of slower growth throughout the economy. Third-quarter gross domestic product growth came in at 3.5 percent (annualized). This result was down from 4.2 percent in the second quarter. The pullback from the torrid pace of the second quarter is a bit disappointing. But it was also expected and still represents a healthy level of growth.

One of the major drivers of slower economic growth was a decrease in consumer spending. Retail sales disappointed for the second straight month in September, with a modest gain of 0.1 percent. This might indicate that the high levels of spending we saw in the second quarter were unsustainable. Despite the slowdown, spending growth remains at levels that will support continued economic growth for the time being.

Slowing wage income growth likely drove this slower spending growth. In September, only 134,000 new jobs were added, the worst monthly result since September 2017. Wage growth also declined to 2.8 percent on an annualized basis. The news turned around for October, however, as employers added 250,000 jobs, and annual wage income growth rebounded to 3.1 percent. The hurricanes in September and October may have distorted the results for both months, but there is a real prospect for job growth to continue at a strong pace through the rest of the year. Still, there may be constraints given the record number of job openings in the country and an unemployment rate of 3.7 percent.

Housing sales disappoint

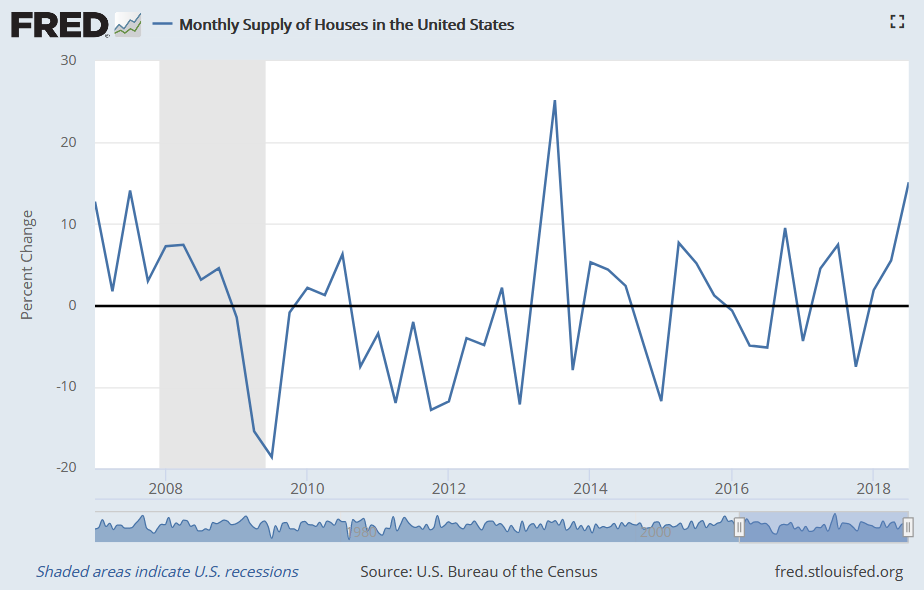

With the economy growing but slowing, the housing market also extended its slowdown. Both new and existing home sales fell in September, as higher mortgage rates discouraged would-be buyers. Slower demand growth also resulted in relatively large growth in available housing supply in the third quarter. As you can see in Figure 1, supply grew at a modest rate in the first half of the year. But in the third quarter, housing supply grew more than 15 percent, the second-fastest rate since the last recession.

Figure 1. Monthly Supply of Housing in the U.S. (Quarterly Change), 2008–2018

Economists have cited a lack of supply as one of the reasons for the slowdown in housing this year. This time, however, lack of supply was not the cause. The decline in housing sales in September was disappointing, but there may be a lag between increased supply and sales growth. The recent hurricanes have also likely had an effect, as they did on jobs. So, October’s data will be worth watching. Home builders remain confident in the market, so things may pick up again.

Political risks take center stage

Once again, we’ve seen the major effect that politics can have on the markets. Here in the U.S., the upcoming midterm elections have generated a lot of media coverage and increased public uncertainty. But from an investment perspective, it does not matter who ends up controlling the House and the Senate. Any result is likely to be positive for the markets as the uncertainty subsides and the policy path forward becomes clearer. Historically, markets have performed well following midterms. As such, and given the usual positive year-end trends, tailwinds may resume after the midterms are over.

From an international perspective, concerns surrounding a global slowdown spooked the markets. Brexit, as well as the struggle between the Italian government and the European Union, has increased political uncertainty and economic fears in Europe. Further, German Chancellor Angela Merkel announced she will be stepping down as head of her party at the end of 2018. This move leaves the door open for new leadership in Germany for the first time in almost two decades. German leadership has been a major source of stability during Merkel’s time in office, so this will be a closely followed transition.

Last but not least, the ongoing trade disputes between the U.S. and China continue to rattle markets. With a new round of tariffs pending, and companies trying to deal with the effect, this remains a source of risk.

Short-term risks remain, but fundamentals are strong

Concerns over a slowing global economy, elections, trade, and rising interest rates could affect the markets. As such, the volatility seen in October could continue. That said, we have also seen strong corporate earnings growth and solid economic data. Plus, economic growth has remained steady, even through the slowdown. Given these healthy fundamentals, we are well positioned to weather any further volatility.

It’s also important to keep in mind that the uncertainty will subside. The midterms will pass, and Europe will likely find a deal again. Even a trade agreement remains possible, which would substantially calm markets.

Of course, short-term volatility is concerning and the risks are real. But when you look at the big picture, things look good right now. Given the otherwise healthy state of the economy, prospects remain positive. Even if there is more volatility ahead, over the long term, a well-diversified portfolio matched with an investor’s time horizon offers the best path to reaching financial goals.

All information according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Barclays Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg Barclays government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg Barclays U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, fixed income analyst, at Commonwealth Financial Network®.

© 2018 Commonwealth Financial Network®