Presented by Mark Gallagher

General market news

• After jumping as high as 3.01 percent last Wednesday—the same day that the Federal Reserve (Fed) decided not to raise rates—the yield for the 10-year Treasury opened at 2.95 percent this morning. The yield for the 30- and 2-year Treasuries opened at 3.09 percent and 2.64 percent, respectively.

• The yield curve remains very flat, and the spread between short and long rates remains slightly off its lows. It looks as if the Fed will hike rates in September—or at least once more this year—possibly pushing the curve to new cycle lows in terms of spreads.

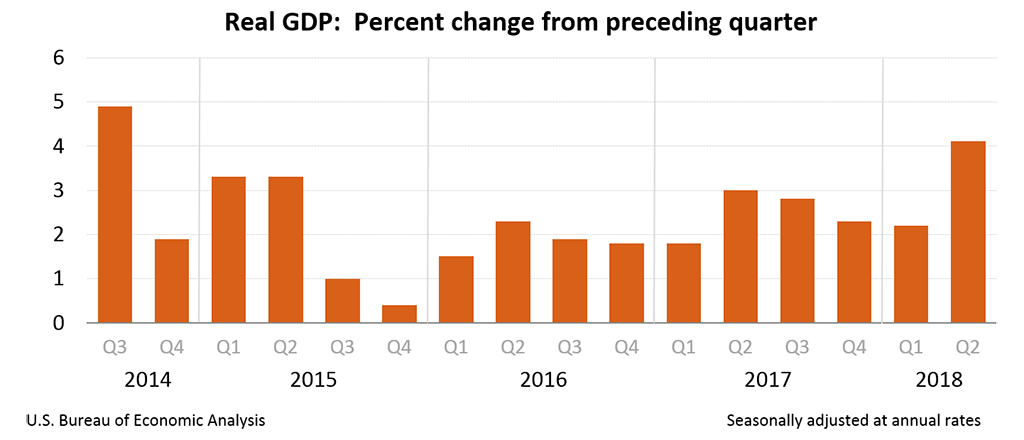

• As noted above, surprising few observers, the Federal Open Market Committee did not raise interest rates at last Wednesday’s meeting. It did, however, provide “strong” hints of a September hike by repeatedly noting the strength of the U.S. economy.

• The three major U.S. indices were all up last week. They were led by the Nasdaq, which posted a 0.98-percent gain. Despite continued volatility surrounding U.S.-China trade policy, stocks seemed to brush off the continued noise, as strong earnings helped support markets.

• On Tuesday, Bloomberg reported that the U.S. and China were trying to restart their trade talks to avoid a trade war, but the Wall Street Journal later suggested that these talks were in the preliminary stages. As the week went on, volatility ramped up further, as the Trump administration confirmed that it was considering raising the $200 billion tariff on Chinese goods to 25 percent from the previously planned 10 percent.

• In the earnings picture, Apple calmed technology and FAANG stock (i.e., Facebook, Amazon, Netflix, and Google) fears, as strong service revenue growth and pricing helped it beat earnings. On Thursday, the tech giant’s stock passed $1 trillion in market cap—the first company’s valuation ever to do so.

• Last week was a busy one for economic updates. On Tuesday, personal income and personal spending both showed growth of 0.4 percent in June, matching expectations.

• On Wednesday, the Institute for Supply Management Manufacturing index declined slightly. Even so, manufacturers’ confidence is still at an expansionary level.

• Finally, Friday saw the release of July’s employment report. Last month, 157,000 new jobs were added, against expectations for 193,000. Although the headline figure disappointed, June’s report was revised up by 35,000, nearly enough to offset the shortfall.

| Equity Index | Week-to-Date | Month-to-Date | Year-to-Date | 12-Month |

| S&P 500 | 0.80% | 4.63% | 7.40% | 16.88% |

| Nasdaq Composite | 0.98% | 4.06% | 13.83% | 24.12% |

| DJIA | 0.05% | 5.04% | 4.28% | 18.29% |

| MSCI EAFE | –1.45% | 1.26% | –1.17% | 4.84% |

| MSCI Emerging Markets | –1.67% | 1.01% | –5.61% | 3.05% |

| Russell 2000 | 0.63% | 1.91% | 9.73% | 19.95% |

Source: Bloomberg

| Fixed Income Index | Month-to-Date | Year-to-Date | 12-Month |

| U.S. Broad Market | 0.09% | –1.50% | –0.87% |

| U.S. Treasury | 0.07% | –1.42% | –1.37% |

| U.S. Mortgages | 0.11% | –0.95% | –0.43% |

| Municipal Bond | –0.11% | –0.11% | 0.73% |

Source: Morningstar Direct

What to look forward to

This week’s data is all about prices—and whether inflation is picking up.

On Thursday, the producer price reports are expected to show that the headline index, which includes energy and food, rose 0.3 percent for July, the same as the 0.3-percent increase in June. There may be some downside here, on declining energy prices. The question will be how much that factor is offset by tariff-driven increases in other input prices, especially steel and electronics. The annual change is expected to stay stable at 3.4 percent, indicating that longer-term inflation pressures remain above the Fed’s target range. The core index, which excludes energy and food, is also expected to remain steady at 0.3 percent for July, the same as for June. The annual number should remain solid at 2.8 percent. Although these figures are stable in the aggregate, under the surface, tariffs are reportedly driving a faster rise in inflation. The effect of tariffs, however, is not expected to show up in the aggregate numbers yet.

Also on Thursday, the consumer price reports are expected to show rising inflation at the headline level. The headline index, which includes food and energy, is expected to have risen 0.2 percent in July, up from 0.1 percent in June. The annual figure is also expected to have risen from 2.9 percent in June to 3 percent in July. The core price index, on the other hand, is expected to remain steady, with the monthly figure at 0.2 percent and the annual figure staying put at 2.3 percent. As with the producer price numbers, these figures would indicate that inflation continues to run above the Fed’s target levels, which should continue to drive interest rates up.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg Barclays US Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg Barclays US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg Barclays US Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

© 2018 Commonwealth Financial Network®