Presented by Mark Gallagher

General market news

• The Treasury yield curve continues to flatten, with the 10-year, 30-year, and 2-year Treasuries coming in on Monday morning at 2.83 percent, 2.94 percent, and 2.60 percent, respectively. The difference in yield between the 2-year and 30-year Treasuries is at a cycle low of 34 basis points (bps). The difference in yield between the 5-year and 10-year Treasuries is down to 9.7 bps, and the difference between the 2-year and 5-year Treasuries is 14.8 bps.

• In a role reversal from the prior week, small-cap stocks and the Russell 2000 were among the laggards. The Dow Jones Industrial Average and Nasdaq Composite, on the other hand, rose as the market favored a risk-on rally led by technology, industrials, and consumer discretionary. Positive second-quarter earnings sentiment was cited as one of the main reasons for this strong performance, with FactSet showing second-quarter S&P 500 EPS growth of 20 percent. This level of growth would be the second highest since the third quarter of 2010 and would be due in part to the tax overhaul and higher buyback levels throughout the quarter.

• Amazon bolstered consumer discretionary performance with its announcement of a new program that would allow entrepreneurs to start their own delivery business. This program should reinforce Amazon’s last-mile efforts, and many believe it will also serve as a bargaining chip when negotiating delivery costs with other providers (e.g., UPS and FedEx).

• Last week was a quiet one for economic updates. On Wednesday, the Producer Price Index came in higher than expected, with 0.3-percent month-over-month growth dragging the annual figure to 3.1 percent. On Thursday, the Consumer Price Index also showed strong inflation levels, with a 2.9-percent annual gain.

• On Friday, the University of Michigan consumer sentiment survey declined slightly from 98.2 to 97.1. This result still represents a very strong reading.

| Equity Index | Week-to-Date | Month-to-Date | Year-to-Date | 12-Month |

| S&P 500 | 1.55% | 3.13% | 5.86% | 16.67% |

| Nasdaq Composite | 1.79% | 4.23% | 14.01% | 26.09% |

| DJIA | 2.32% | 3.16% | 2.41% | 18.75% |

| MSCI EAFE | 0.17% | 0.74% | –1.69% | 6.93% |

| MSCI Emerging Markets | 1.70% | 1.01% | –5.66% | 6.06% |

| Russell 2000 | –0.40% | 2.71% | 10.59% | 19.84% |

Source: Bloomberg

| Fixed Income Index | Month-to-Date | Year-to-Date | 12-Month |

| U.S. Broad Market | 0.42% | –1.20% | –0.06% |

| U.S. Treasury | 0.23% | –0.85% | –0.36% |

| U.S. Mortgages | 0.23% | –0.73% | 0.22% |

| Municipal Bond | 0.35% | 0.10% | 1.76% |

Source: Morningstar Direct

What to look forward to

This will be a busy week for economic news, with wide-ranging reports.

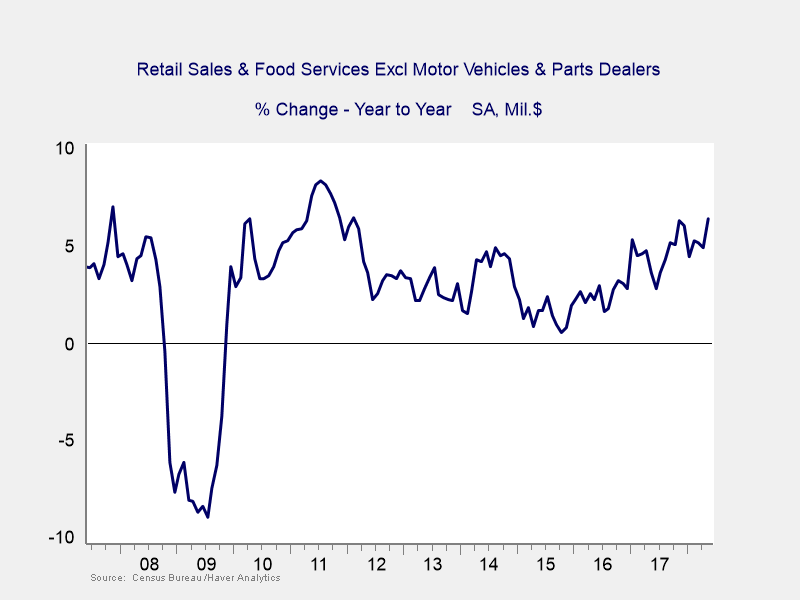

On Monday, the retail sales report showed growth of 0.5 percent for June. This number is down from May’s 0.8-percent growth but is still at a very strong level. This result is supported by a recovery in auto sales growth and is in line with expectations. Core retail sales, which exclude autos, also showed slower growth. The core number was down from 0.9 percent in May to 0.4 percent in June, coming in slightly above expectations for 0.3-percent growth. After a strong series of gains, these numbers still represent healthy growth and confident consumers who continue to spend.

On Tuesday, the industrial production report is expected to tick up. After a decline of 0.1 percent in May, this report should show a 0.5-percent gain for June due to an increase in oil drilling as prices rise. Manufacturing is likely to show an even bigger improvement. Coming off of a 0.6-percent decline in May, which was largely the result of a fire that disrupted auto industry supply chains, this report is expected to rebound for a gain of 0.5 percent in June. If the numbers come in as expected, they would signal continued economic growth.

Chair Powell will testify before the Senate on Tuesday and the House on Wednesday in the regular semiannual session. The markets will be looking for the Federal Reserve’s take on the rising trade confrontation and its effects on the economy, as well as what it may mean for interest rates. Currently, no changes are expected.

We’ll also get a look at the housing sector on Tuesday with the release of the National Association of Home Builders (NAHB) Housing Market Index and on Wednesday with the housing starts report. After last month’s pullback due to a drop in lumber prices, the NAHB index is expected to tick up slightly from 68 in June to 69 in July. Housing starts should drop slightly from 1.35 million in May to 1.33 million (annualized) in June. This result would be due to a decline in single-family building permits in prior months. If the housing starts number comes in as expected, it will mean that housing may be experiencing a minor slowdown.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg Barclays US Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg Barclays US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg Barclays US Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2018 Commonwealth Financial Network®