Presented by Mark Gallagher

General market news

• The yield on the 10-year Treasury opened at 2.89 percent on Monday; the 30-year and 2-year opened at 3.14 percent and 2.26 percent, respectively. Although rates have moved higher over the past five to six months, the spreads in yield between the 2-year and 10-year and between the 2-year and 30-year have remained near current-cycle lows, indicating a very flat yield curve.

• All three major U.S. indices were up more than 3 percent last week. Friday’s strong employment report, which indicated that the economy added 313,000 jobs in February, helped propel markets higher. In addition, inflation fears eased, as hourly earnings dropped to an increase of 2.6 percent year-over-year. This was down from 2.9 percent in January.

• The week was not without its concerns, however. Gary Cohn, President Trump’s chief economic advisor, stepped down following news that the tariffs on steel and aluminum would be implemented. As the week progressed, fears of a trade war and the affect of the tariffs eased as exemptions were put in place for Canada and Mexico. Additionally, it was stated that U.S. allies could potentially be exempt if they were to offer the U.S. concessions on trade.

• The financial sector was the top performer on the week, benefiting from the Senate’s continued work on the Dodd-Frank Act, which could potentially ease regulations within the sector.

• Last week was relatively quiet in terms of major economic news. On Monday, the Institute for Supply Management’s Nonmanufacturing composite declined slightly to 59.5, above expectations for a further fall to 59. This measure of confidence in the service economy remains in healthy expansionary territory.

• As mentioned above, the February employment report came in much better than expected. In addition, there were upward revisions to both December and January figures. Much of this surprise growth came from increased participation, as the participation rate ticked up from 62.7 percent to 63 percent. Unemployment remained unchanged at 4.1 percent. Going forward, the strength of the labor market likely will lead to further Federal Reserve rate hikes in 2018.

| Equity Index | Week-to-Date | Month-to-Date | Year-to-Date | 12-Month |

| S&P 500 | 3.59% | 2.75% | 4.63% | 20.18% |

| Nasdaq Composite | 4.20% | 4.00% | 9.76% | 30.89% |

| DJIA | 3.34% | 1.32% | 3.02% | 24.33% |

| MSCI EAFE | 1.88% | –0.39% | –0.11% | 20.42% |

| MSCI Emerging Markets | 2.18% | 1.06% | 4.46% | 34.21% |

| Russell 2000 | 4.20% | 5.65% | 4.21% | 18.98% |

Source: Bloomberg

| Fixed Income Index | Month-to-Date | Year-to-Date | 12-Month |

| U.S. Broad Market | –0.13% | –2.22% | 1.60% |

| U.S. Treasury | –0.04% | –2.15% | 0.59% |

| U.S. Mortgages | –0.02% | –1.84% | 1.21% |

| Municipal Bond | 0.01% | –1.46% | 3.41% |

Source: Morningstar Direct

What to look forward to

With five major reports expected, this will be a busy week for economic news.

We’ll kick things off on Tuesday with the consumer prices report. The headline number, which includes food and energy, is expected to drop from a 0.5-percent increase in January to a more modest 0.2-percent increase in February, as surges in energy prices normalize. The annual figure, however, is expected to rise from 2.1 percent to 2.2 percent. Core inflation, which excludes food and energy, is also expected to drop on a monthly basis, from 0.3 percent in January to 0.2 percent in February. The annual figure in this case, though, is expected to stay steady at 1.8 percent. If these numbers come in as expected, they would indicate stable conditions.

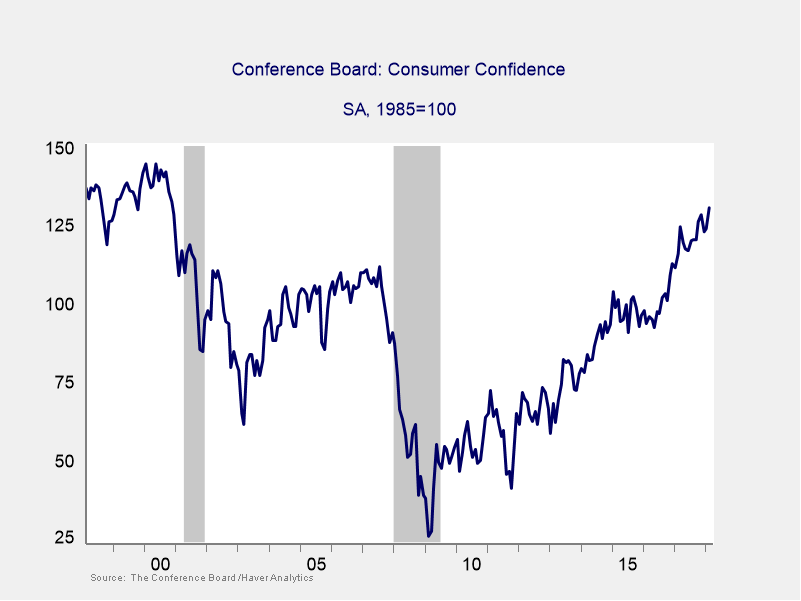

On Wednesday, the retail sales report is expected to show renewed strength. The headline number, including autos, is expected to rise from a 0.3-percent decline in January to a 0.3-percent increase in February, as auto sales bounce back. Core sales, which exclude autos, are expected to improve as well, from a flat result in January to a 0.4-percent increase in February. The boost in take-home pay resulting from the tax bill, along with high consumer confidence, should drive sales higher.

On Thursday and Friday, respectively, we get the National Association of Home Builders (NAHB) industry survey and the housing starts report. The NAHB survey is expected to stay steady at 72, which is a high level, although there may be some downside risk based on supply and labor shortages. After jumping to a 16-year high in January, housing starts are expected to tick down from 1.326 million to 1.286 million, as multifamily construction drops back even as single-family construction continues to rise. These would be healthy reports if they come in as expected.

On Friday, the industrial production report is expected to improve, with the headline figure rising from a decline of 0.1 percent in January to a gain of 0.3 percent. Manufacturing is expected to show a similar gain, from flat in January to 0.3-percent growth in February. With both oil production and manufacturing showing strength, we could see even faster growth here.

Finally, and also on Friday, the University of Michigan consumer confidence survey is expected to pull back from 99.7 in February—the second-highest level since 2004—to 99.5 in March on stock market volatility. Here as well, there looks to be upside potential, given faster employment growth and strong results in other confidence surveys.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg Barclays US Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg Barclays US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg Barclays US Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2018 Commonwealth Financial Network®