Presented by Mark Gallagher

General market news

• The yield on the 10-year Treasury, which has been testing higher levels over the past two weeks, opened north of 2.80 percent on Monday morning. Although the short-term trend has been higher, we’ll have to wait to see if the 10-year can break new levels. With the 30-year barely above 3 percent, it might be difficult.

• The three major U.S. indices were down more than 5 percent last week, and both the Dow Jones Industrial Average and the S&P 500 officially entered correction territory. The largest declines occurred in the financials, telecom, and energy sectors, as the price of oil continued to fall. The top performers included utilities, materials, and real estate.

• The reasons for the market pullback include inflation fears, rising interest rates, and higher bond yields. A bump in the hourly wage growth rate to 2.9 percent in the January jobs report may have stemmed fears that the Federal Reserve (Fed) will accelerate its planned rate hikes (the market currently expects three hikes this year). Nevertheless, as the Fed continues winding down the balance sheet under the leadership of a new chair, Jerome Powell, the belief is that the economy will now have to stand on its own. The days of artificially low rates may be over.

• Earnings, on the other hand, have continued to come in strong. Of the nearly three-quarters of S&P 500 companies that have reported so far, more than 80 percent of them experienced better-than-expected profits in the fourth quarter.

• Last week was relatively quiet in terms of major economic news. On Monday, the Institute for Supply Management’s Nonmanufacturing composite recovered from a surprise decline in December, rising to 59.9 from 55.9. Confidence for both manufacturers and the service industry is near multiyear highs.

• On Wednesday, consumer credit rose by less than expected. The savings rate is at a 12-year low, so we’ll want to keep an eye on expanding credit use.

| Equity Index | Week-to-Date | Month-to-Date | Year-to-Date | 12-Month |

| S&P 500 | –5.10% | –7.14% | –1.84% | 15.77% |

| Nasdaq Composite | –5.01% | –7.19% | –0.32% | 21.67% |

| DJIA | –5.08% | –7.35% | –1.90% | 22.79% |

| MSCI EAFE | –6.19% | –7.44% | –2.78% | 18.56% |

| MSCI Emerging Markets | –7.14% | –8.90% | –1.31% | 26.59% |

| Russell 2000 | –4.47% | –6.12% | –3.67% | 8.62% |

Source: Bloomberg

| Fixed Income Index | Month-to-Date | Year-to-Date | 12-Month |

| U.S. Broad Market | –0.77% | –1.92% | 1.09% |

| U.S. Treasury | –0.56% | –1.91% | –0.09% |

| U.S. Mortgages | –0.59% | –1.75% | 0.46% |

| Municipal Bond | –0.22% | –1.40% | 3.01% |

Source: Morningstar Direct

What to look forward to

This week’s economic data will cover wide slices of the economy.

On Wednesday, we’ll learn about consumer prices. Headline inflation, which includes food and energy, is expected to increase by 0.4 percent in January, up from a 0.2-percent increase in December, on higher gasoline and natural gas prices. On an annual basis, however, headline inflation is expected to decline—from 2.1 percent to 2 percent—due to base effects from one year ago. Core prices, which exclude food and energy, are expected to show a smaller increase, dropping from 0.3 percent in December to 0.2 percent in January. This would take the annual rate down to 1.7 percent.

We will also see the retail sales report on Wednesday. The headline number, which includes autos, is expected to drop from 0.4-percent growth in December to 0.3-percent growth in January. This would be due to a decline in auto sales, as the post-hurricane replacement sales wind down. Core retail sales, which exclude autos, are expected to increase from a 0.4-percent gain in December to a 0.5-percent gain in January. Much of this increase, though, would come from higher gasoline prices rather than higher spending on other items.

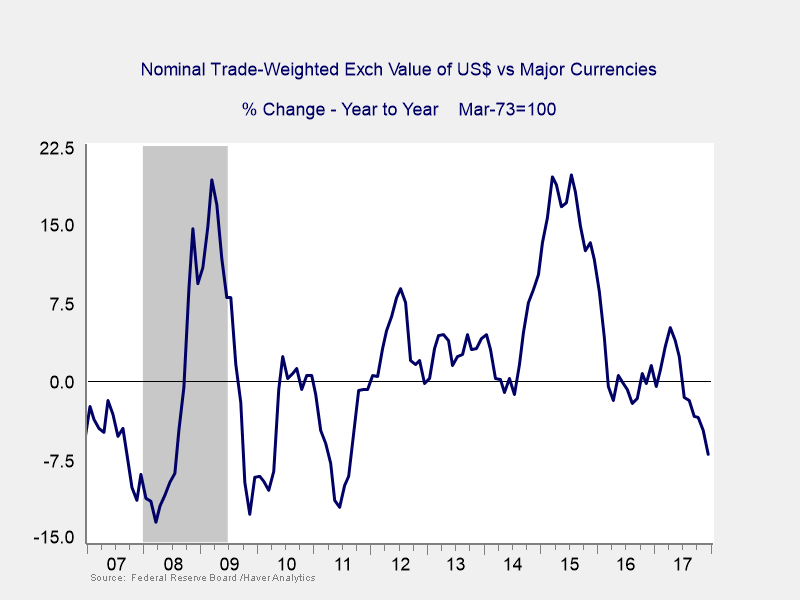

On Thursday, the industrial production report is expected to decline sharply, from a 0.9-percent increase in December to a 0.2-percent increase in January. Much of this decline, however, would be due to more normal weather conditions, just as last month’s increase resulted from higher utilities output caused by unusually cold weather. As such, this indicator would remain at a healthy level. Manufacturing output growth is expected to rise from 0.1 percent in December to 0.3 percent in January, as this sector continues to benefit from a weaker dollar and strong global demand.

Turning to the housing sector, on Thursday, the National Association of Home Builders survey is expected to remain at a strong 72, which is consistent with continued growth. On Friday, housing starts, which declined in December to an annual rate of 1.19 million, are expected to rebound in January to a rate of 1.25 million. Such increase would be due to a rise in building permits, which reached a 10-year high in December.

Finally, on Friday, the University of Michigan consumer confidence survey is expected to drop back marginally, from 95.7 in January to 95.5 in February. Strong job growth is expected to support this index, although the recent stock market pullback might present some downside risk.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg Barclays US Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg Barclays US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg Barclays US Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2018 Commonwealth Financial Network®