Click here -> Generic Tax Organizer 2020 for the 2021 Tax Season

After a rollercoaster year, the 2021 tax filling season is fast-approaching once again. Without a doubt, the Covid-19 pandemic has introduced a paradigm shift in our daily routines! As we all adapt to what’s been deemed “the new normal”, Gallagher Financial Services is committed to being here for you. We also are very grateful to have you among our good and loyal clients – thank you!

Amidst the concerns of a lingering pandemic that involves various forms of “social distancing”, Gallagher Financial Services seeks to provide viable options for us to effectively prepare your taxes. While we still intend to offer some in-office appointments, we also have other innovative alternatives. At the forefront, we’ve implemented a secure client portal called CCH iFirm that’s integrated with our tax program. This new portal will enable us to easily and seamlessly share tax docs back and forth with you. The CCH iFIrm platform even includes the option for you to electronically sign your tax return (similar to DocuSign). Of course, you may still prefer to mail us your tax docs or drop them off in person – curbside options available!

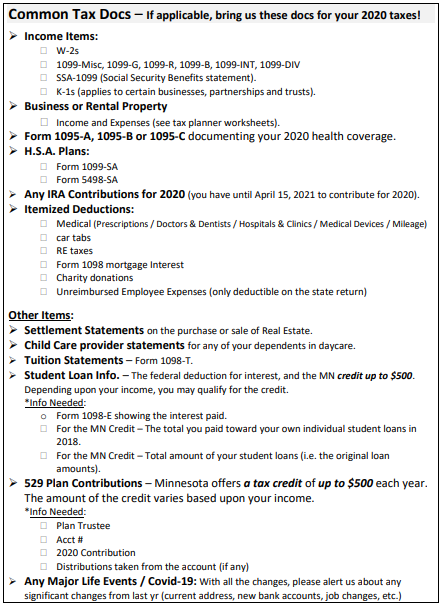

Whichever method, please provide us with all your pertinent 2020 tax documents. This post contains a convenient checklist (found below) of common tax documents we’ll need this tax season as well as a link to our 2020 Tax Organizer (found above). As in previous years, clients with more elaborate taxes can also refer to our tax planner worksheets that are tailored to your unique situation.

This year, more than ever, please consider getting us your tax documents in advance. Especially folks who received unemployment benefits that may be concerned about the tax consequences! From our perspective, it seems best to know in advance – even if there’s negative new that allows time for some proactive planning. For those who are tech savvy, we strongly urge you to use the new CCH iFirm portal.

To Use the New Client Portal – Utilize our New Client Portal to share your tax docs with us. This paperless option also has an option for you to review and electronically sign your tax docs.

- Give us a call at 651-774-8759 to request to use the portal

- Alternatively, email Jeff at Jeff@gallagherfinanialservies.com

Noteworthy Items:

- Stimulus Checks – The Economic Impact Payment you received is tax-free!

- Unemployment Benefits – If applicable, we will need a copy of Form 1099-G

- Pandemic Relief for Business Owners – Include your PPP loan status, EIDL loans or advances, along with other government grants you received

- Medical Expenses – If you can benefit from itemizing, the amount of your medical expenses over 10% is deductible

- Health Insurance – If you buy your insurance through the MNSURE exchange, bring us a copy of the 1095-A

- H.S.A. Plans – If you’ve contributed or received distributions from a Health Savings Account, we will need Form 5498 and Form 1099-SA

- 529 Plans – MN allows a tax credit of up to $500 per year

As always, you may contact our office with your questions or concerns. you can reach us me by email at Mark@markgallagher.com or call my office at 651-774-8759 and a member of my team will be eager to assist you!